Management incentive equity plans help align investors with the management team running the business. In every control private equity transaction, it is one of the most important variables to get right. This post will explain how equity compensation generally works with visuals that should help cement these concepts.

The amount of vocabulary surrounding equity incentives can be overwhelming. A lot of this complication stems from nuances in federal tax law, but the simple objective, no matter how equity incentives are structured, generally remains the same: incentivize the management team to increase the equity value of the business that employs them. This is achieved by providing the key personnel driving growth with the opportunity to own a piece of the business above a certain value. Ownership is represented by either units or shares (based on the type of entity), and the value above which the employee is entitled to a payout is generally tied to the value of the company when the employee is hired.

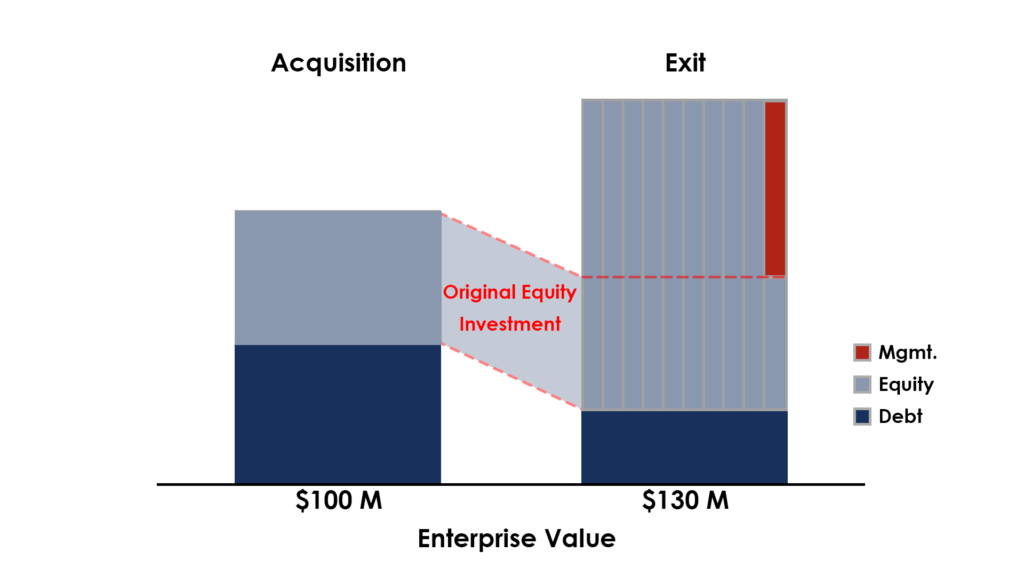

So, let’s assume that a private equity firm acquires a company with an enterprise value of $100M dollars. To attract the right team the private equity firm also creates a management incentive plan equal to 10%.

Per the image above, the 10% incentive plan does not entitle the management team to 10% of the company outright, but rather to 10% of the increase in equity value over time. More precisely, the management team benefits from 10% of the appreciation in equity value after the private equity firm recoups all dollars originally invested, which is the equivalent of earning a multiple of invested capital (MOIC) of 1.0x.

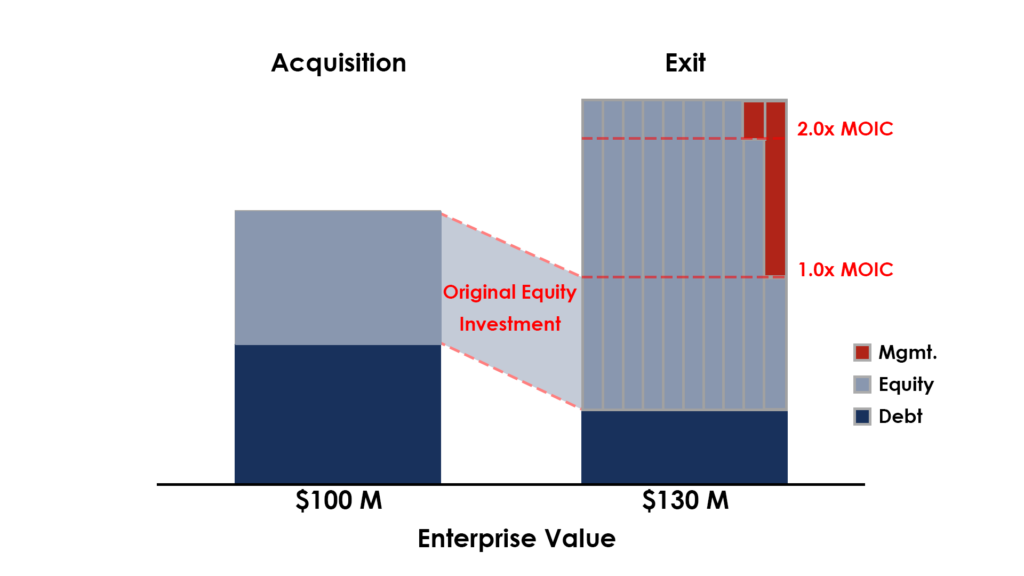

What is a Private Equity Hurdle Rate?

The MOIC of 1.0x is known as a “hurdle rate,” because it is the rate above which the management team is entitled to compensation. A management incentive plan can have multiple hurdle rates (also referred to as tranches or tiers) to further incentivize outsized returns. For example, and per the image below, the private equity team could provide an additional 10% equity incentive above a hurdle rate of 2.0x MOIC.

Per the introduction, there can be any number of nuanced structures. But ultimately, whether you are contemplating stock options or profits interests (the two most common forms of equity compensation in private equity transactions), the mechanics are largely the same.

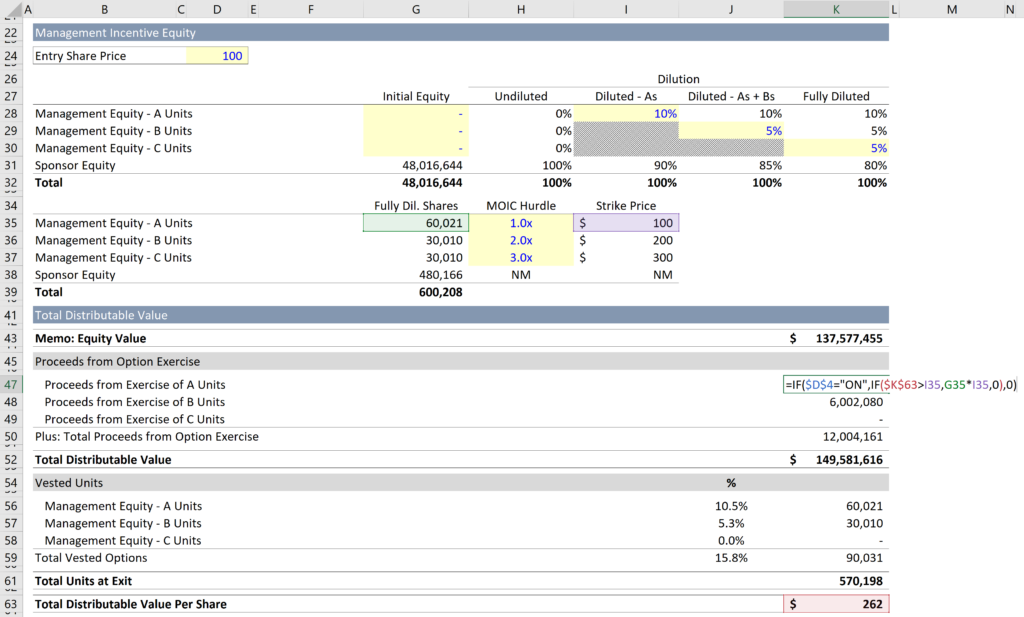

Related: Learn how to build management incentive plans in Excel with the LBO Case Study course (template example visible below).

Learn more about private equity transactions with ASM’s Private Equity Training course. The Private Equity Training course at ASimpleModel.com was developed by industry professionals. The content below goes beyond the LBO model to explain how private equity professionals source, structure and close transactions.