In this post we will cover the M&A auction process from the buyside perspective by detailing a “standard” process for a private equity group. In any process the objective should be to win by the smallest margin possible. Every participant knows this in theory, but the gamesmanship and strategy involved in an M&A auction can make it difficult in practice (as the first video below will demonstrate). But before we dive into the strategy, let’s first outline the process.

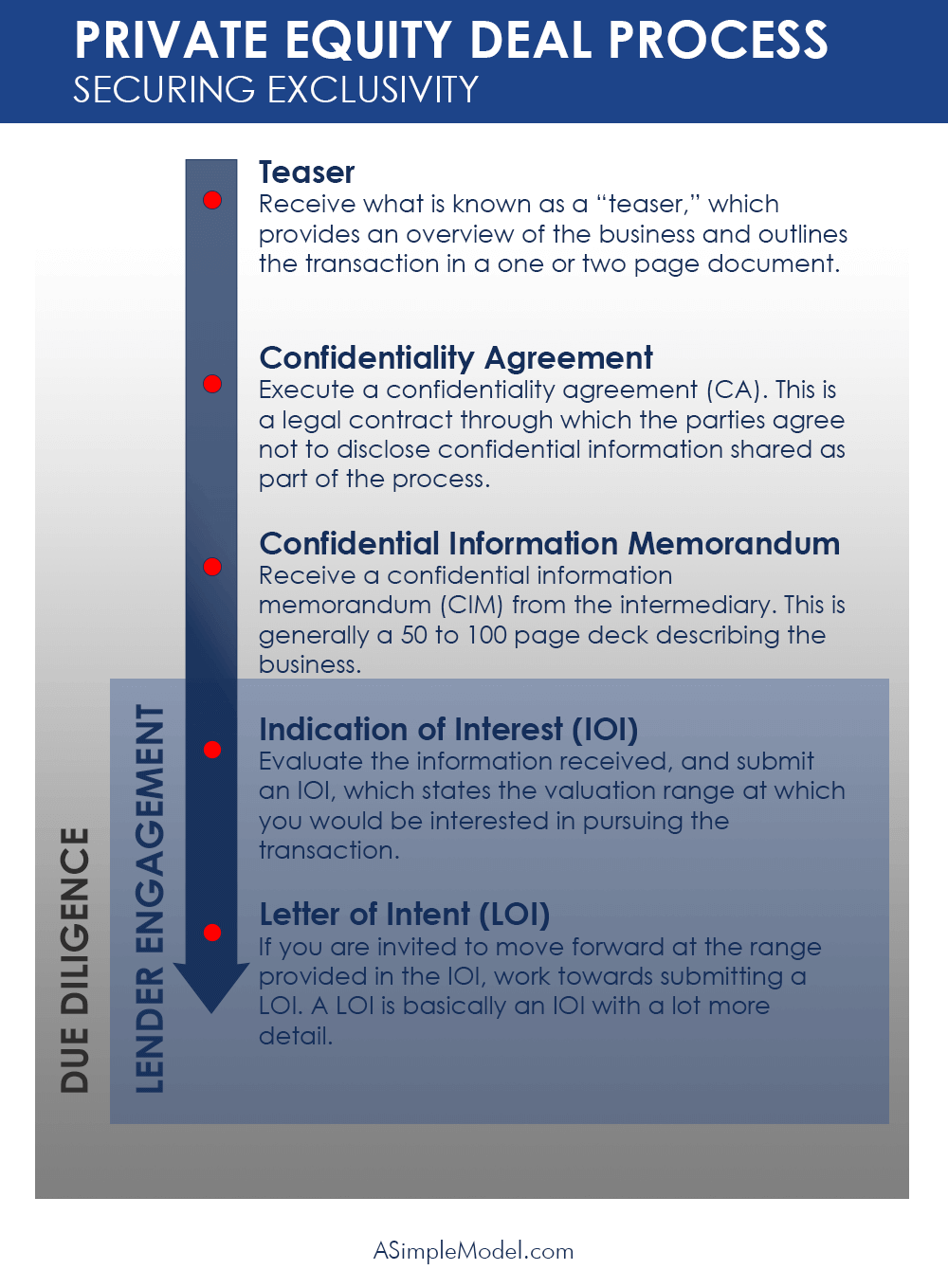

The process is initiated by the investment banker. Per the image below, the investment banker will deliver a teaser to a list of all parties they believe might be interested in the opportunity. At this stage very little information is shared. If the teaser describes an investment opportunity that is even remotely interesting, the private equity firm is likely to execute the confidentiality agreement required to review more information.

Once this document has been executed, the private equity firm will receive a confidential information memorandum. This document provides substantially greater detail, and if the contents confirm the private equity firm’s interest, the next step is to start working towards the submission of an indication of interest (or first round bid if there is to be more than one bid). The image that follows organizes the timeline by the documents that are exchanged.

In this process all potential buyers will be constantly evaluated by the investment banker and seller as they attempt to identify the most suitable buyer. All participants should keep this in mind at all times because this process can be stressful. Maintaining a cool, level-headed approach under any kind of emotional duress will reflect positively and it will potentially provide an advantage in the process.

Unlike the purchase of public securities, acquiring an interest in a privately-held business is highly time consuming. Information is made available only to parties that demonstrate interest, and demonstrating interest requires due diligence. The more work that goes into any process, the greater the bias becomes to win the deal. A talented investment banker can and will use this to their advantage. This can be difficult to understand without an example, so we have included an anecdote describing precisely how this works in the video that follows.

Being aware of the gamesmanship involved does not necessarily answer how best to engage in the process to avoid overbidding (to the degree possible). The ultimate objective in an auction is to work towards an understanding of what it takes to win the process. In an effort to uncover valuation in the current market, private equity firms will take the steps outlined in the video available below.

The final video in this series addresses how private equity firms use the limited amount of information provided to bid. It also addresses how a private equity firm should respond if they arrive at the conclusion that the information provided is misleading.

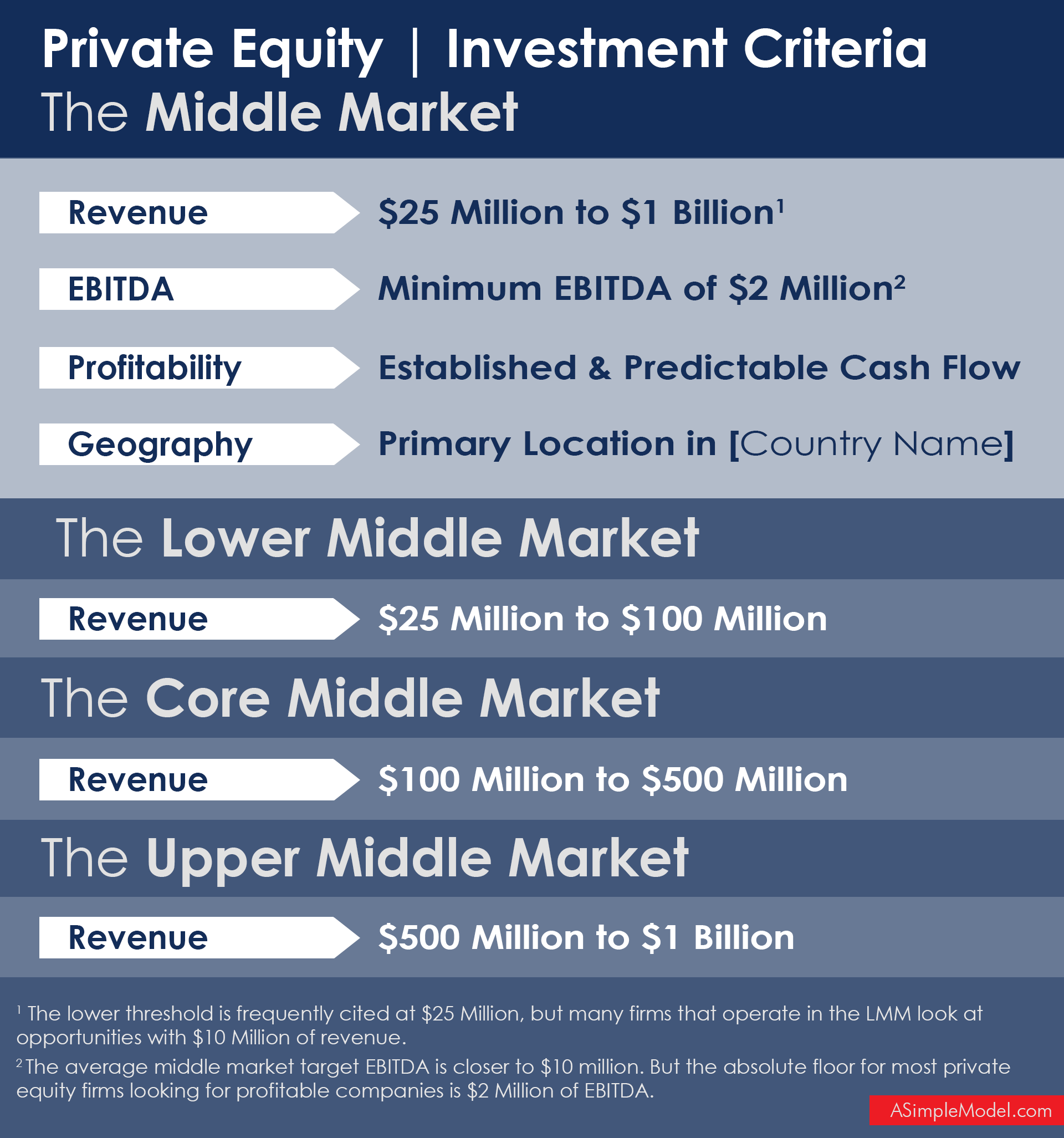

If the private equity firm’s bid is accepted, they will be invited to submit a letter of intent (LOI). This is where scale starts to play more of a role in what is expected, largely because this entire timeline gets pulled forward as scale increases. In the lower-middle-market and core-middle-market of private equity much (definitions included below) due diligence will remain after the LOI has been submitted. On larger transactions there will generally be two rounds of bids before an LOI is submitted, with confirmatory due diligence taking place after the second bid. In the upper middle market and megafund category submitting the letter of intent is viewed as the end of due diligence. At this stage, the expectation is that all third-party work is complete, lenders are lined up and the investment committee has approved the transaction. In either case, and regardless of scale, executing the letter of intent brings the auction to a close. Then it is up to the private equity firm to close the transaction.