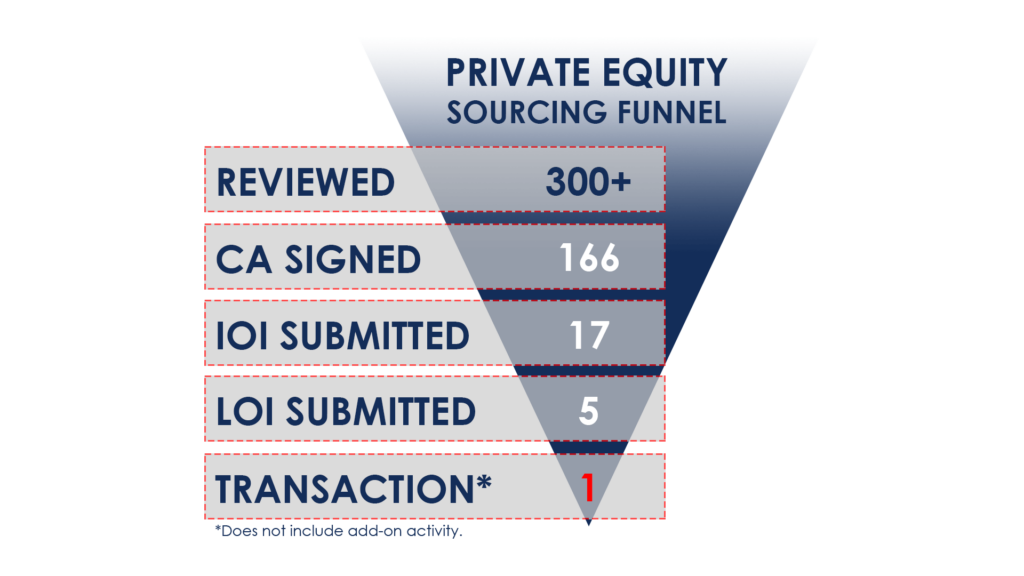

Sourcing an attractive investment opportunity as a private equity professional requires a tremendous amount of work. To provide an idea of the number of opportunities evaluated before making a new platform investment, I have included a sourcing funnel (see image below).

This is actual data from a funnel I used in an investor presentation to explain our process, and I can tell you with confidence that the work required to maintain all of the data surrounding the figures in that image were the most tedious part of my job at the time. This is not an unusual funnel, most industry data supports 100 opportunities reviewed or evaluated for every 1 or 2 transactions consummated.

When I posted this I also found that it resonated with most of my friends that work in the industry. I received several text messages from friends claiming even larger numbers to find one attractive opportunity. One such text claimed that for the last year a private equity firm had on average “reviewed” 400 opportunities for every transaction closed; a “rough year” as they put it.

How “reviewed” is defined changes from firm to firm, but signing a confidentiality agreement (CA) is a pretty easy step to measure. Private equity firms typically keep records of all CAs signed. I think it is common to see 100+ CAs signed for every 1 or 2 transactions closed, which puts the success rate at 2% in the most optimistic scenario.

In private equity, it has been my experience that a considerable amount of an investment team’s effort is dedicated to filtering through transactions that never come to fruition with the objective of finding the few opportunities worth acting on. To maintain all of this information properly, and make sure that the investment team is responding to opportunities in a timely fashion, it’s helpful to have a dedicated Customer Relationship Management (CRM) solution to track all of the parties representing transactions. As the funnel above suggests, each transaction will have a unique timeline associated with the process. There will be deadlines for IOI and LOI submissions that the investment team needs to be aware of.

A well-maintained pipeline not only ensures that these deadlines are not missed, it also helps the investment team maintain a relationship with all of the entities presenting the private equity firm with opportunities. It is important to make an effort to decline each opportunity and provide the rationale for passing because it communicates that the investment team is taking the time to evaluate the materials provided. In an industry where passing on an opportunity is the norm, a cordial response goes a long way.