In this post we will look at what it means to structure a transaction on a “cash free, debt free” basis, and then look at how this is presented and calculated in the context of a financial model.

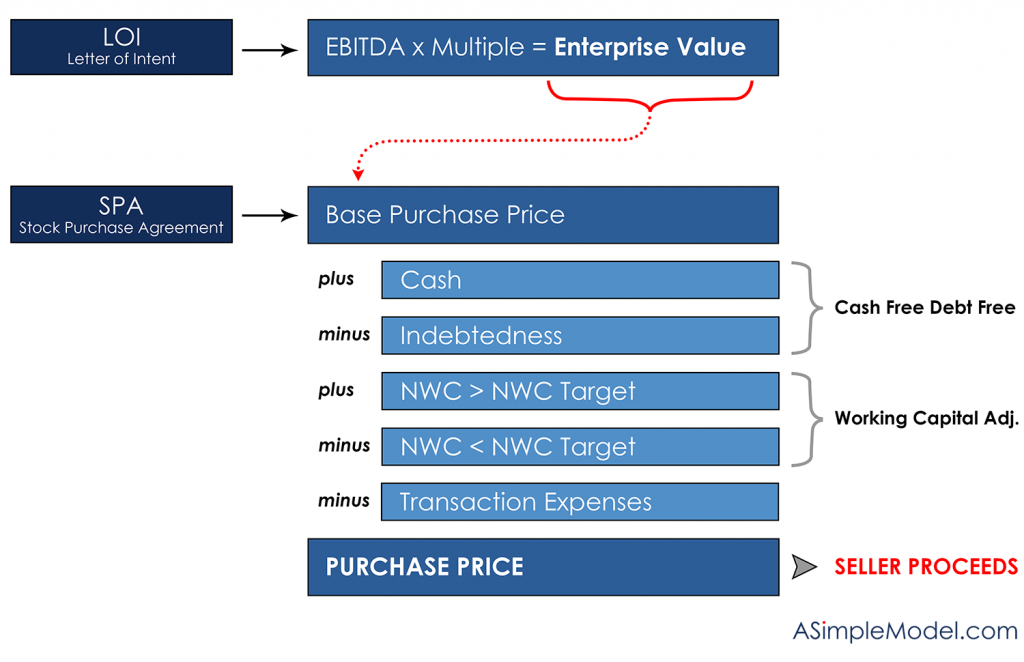

Most control equity transactions (where Buyer acquires a control equity stake) are structured on a cash free, debt free basis. This means that the Seller is entitled to the cash on the balance sheet, and that the Seller is responsible for debts owed by the company (defined as indebtedness in the image below). This language would most likely be first encountered in a Letter of Intent (LOI) submitted to the Seller by the Buyer.

This logic behind a cash free balance sheet is supported by the assumption that the company will have a normalized level of working capital on the closing date of the transaction, which would enable the buyer to continue to operate the business moving forward (more on this topic). Otherwise, inadequate working capital would create an immediate liquidity need. As a conservative measure, and to avoid the associated risk, most acquirors will either secure a revolving line of credit with undrawn capacity prior to close or raise additional funds to include a comfortable cash cushion. In a financial model this cash cushion would appear as a use of cash under sources and uses.

While the Seller is responsible for the amount of Indebtedness, the debts are actually paid by the Buyer. The Seller will obtain and deliver to the Buyer signed payoff letters prior to the closing, and the Buyer will make payments to the appropriate parties with respect to the Indebtedness of the company at the closing.

This effectively reduces the Base Purchase Price by the amount of Indebtedness without requiring the Sellers to manage this process themselves. And since the Buyer has a greater incentive to be certain that these obligations are met, this process provides a greater level of comfort for the Buyer.

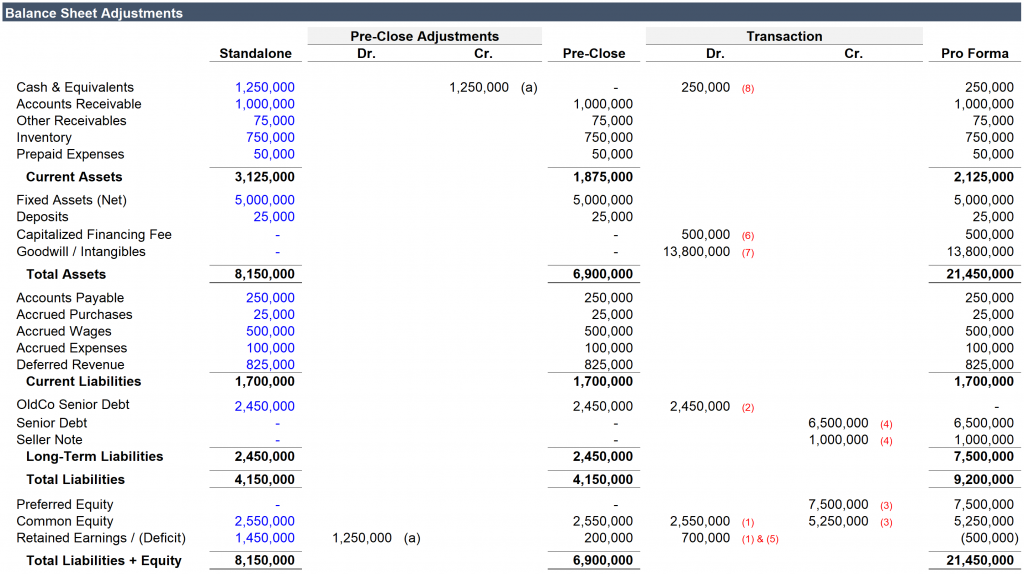

In an LBO model the cash free, debt free adjustments visible in the image above would take place under the balance sheet adjustments visible below (click on the image for a larger view). In this model Cash is eliminated under “Pre-Close Adjustments.”

To reflect a cash-free transaction the sum of cash visible under the balance sheet titled “Standalone” would be eliminated with the following journal entry (denoted by “(a)” in the image).

Debit: Retained Earnings $1,250,000

Credit: Cash $1,250,000

As a simple example, indebtedness would then be paid off in step (2) under “Transaction.” The journal entry to record paying down debt would be to debit the debt balance and credit cash, but reflecting a control transaction in two columns requires several simultaneous transactions. In this case the funds raised to close the transaction would be used to make these payments.

This is a simple example in which only “OldCo Senior Debt” is included in indebtedness. But the definition of indebtedness can go far beyond interest-bearing debt (e.g. term debt, lines of credit, mortgages, lease obligations and shareholder notes) to include items such as extended accounts payable. For this reason, the definition of indebtedness in a stock purchase agreement is always heavily scrutinized. A broader definition of indebtedness gives the Buyer more protection (and leaves the Seller with less proceeds), while a narrower definition of indebtedness increases the sum of proceeds received by the Seller.

For more detail on the balance sheet adjustments and to download the template please see this post. You can also find videos explaining this process as part of the LBO Case Study course.