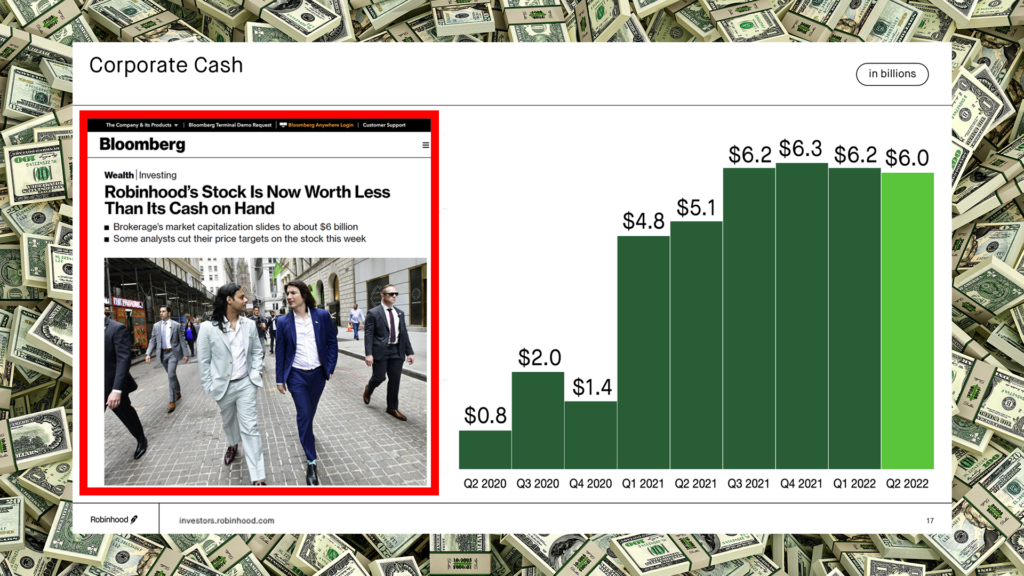

Why not buy Robinhood stock? Why not buy any stock when the company is trading close to the value of the cash it has on the balance sheet? As a quick follow up, you might ask how the company managed to build this cash balance. Because in Robinhood’s case, and per the image below, the cash balance has certainly grown.

Companies can build cash on their balance sheets by issuing debt, issuing equity and by generating a profit.

Sources of Funding for a Company:

- Debt Capital

- Equity Capital

- Retained Earnings (Profit)

Of these the most attractive option for an investor is cash from profitable operations. When a company issues debt, it creates an obligation that the company must repay. When a company issues equity, it dilutes the shares outstanding. But if a company is consistently generating cash flow, it can sustain itself.

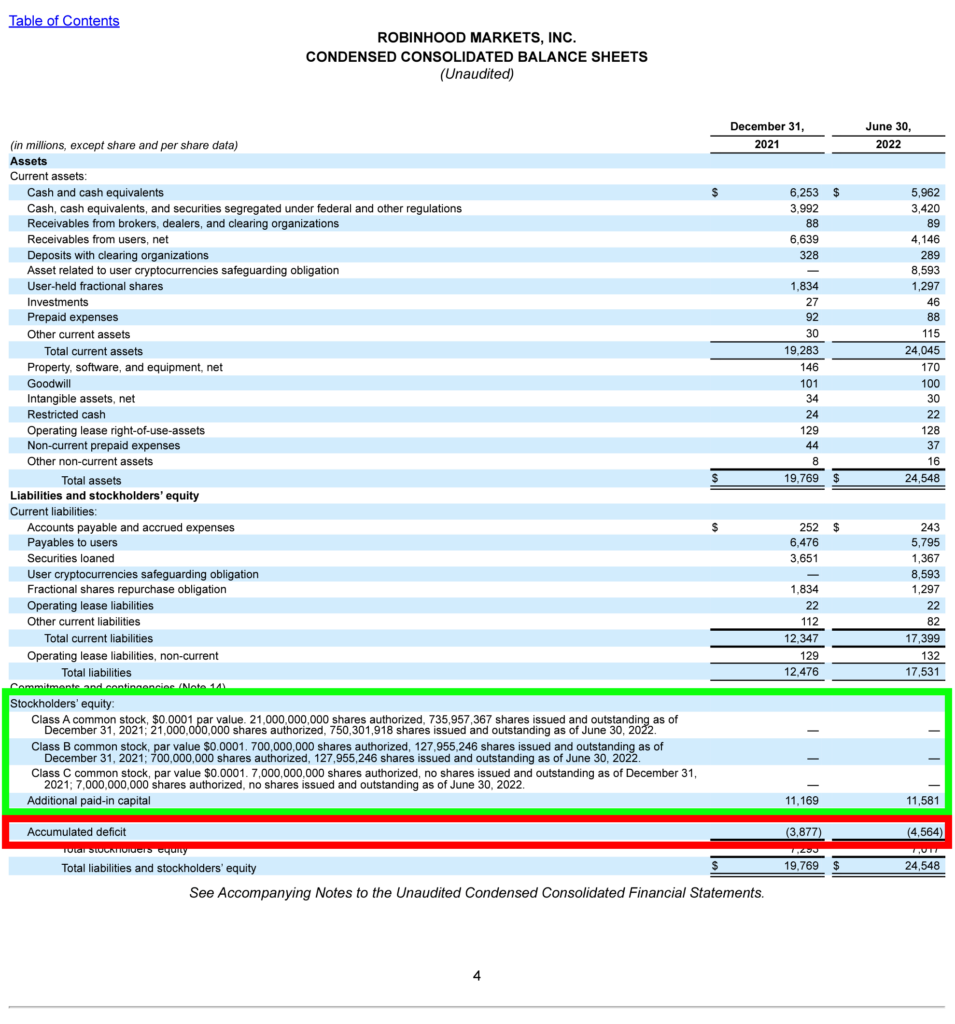

Robinhood has been issuing equity, which is easy to see on the company’s balance sheet (see image below). On a balance sheet, equity capital raises fall under share capital (or contributed capital) and profit builds under retained earnings. Unfortunately if you look at Robinhood’s balance sheet, cash comes from equity raises or share capital (highlighter green rectangle). The company doesn’t have retained earnings. In fact, it has the opposite, an accumulated deficit from operating at a loss (red rectangle).

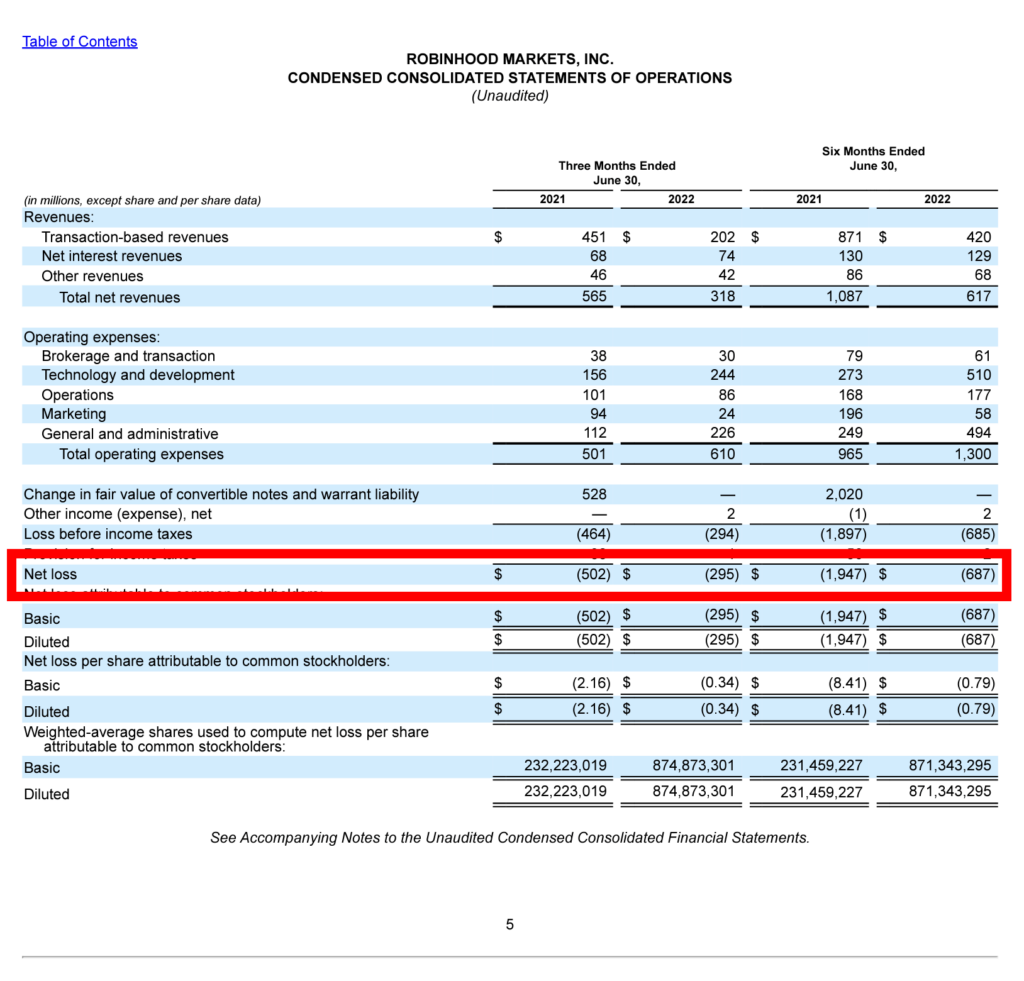

If you look at the income statement, it’s easy to understand the deficit. The company posted a loss of ~$700M for the six months ending June 30 (red rectangle below).

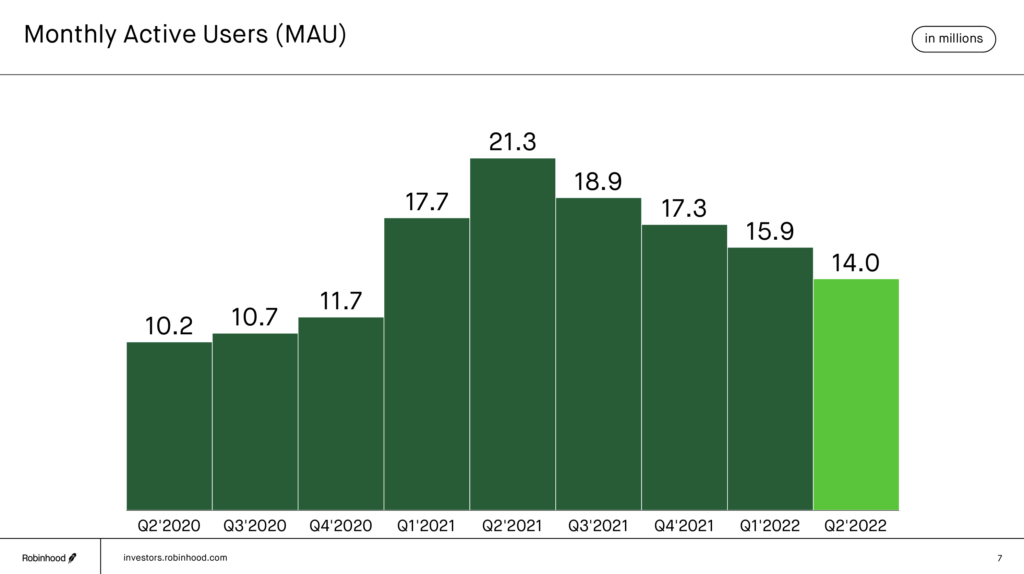

At some point, this requires a profitable operating model, which is what Robinhood executives are focused on. At the moment however, it has challenges to work through (as the share price suggests). A primary example is the drop in user count and revenue per user. (Full presentation available on Robinhood’s Investor Relations website.)

So in this instance the amount of cash on the balance sheet represents the amount of time the company has to turn a profit. Absent the ability to raise new funds, the amount of time available is the amount of cash available divided by how much cash the company loses per year. Do you believe Robinhood can reverse losses and work towards a profitable model within this amount of time?

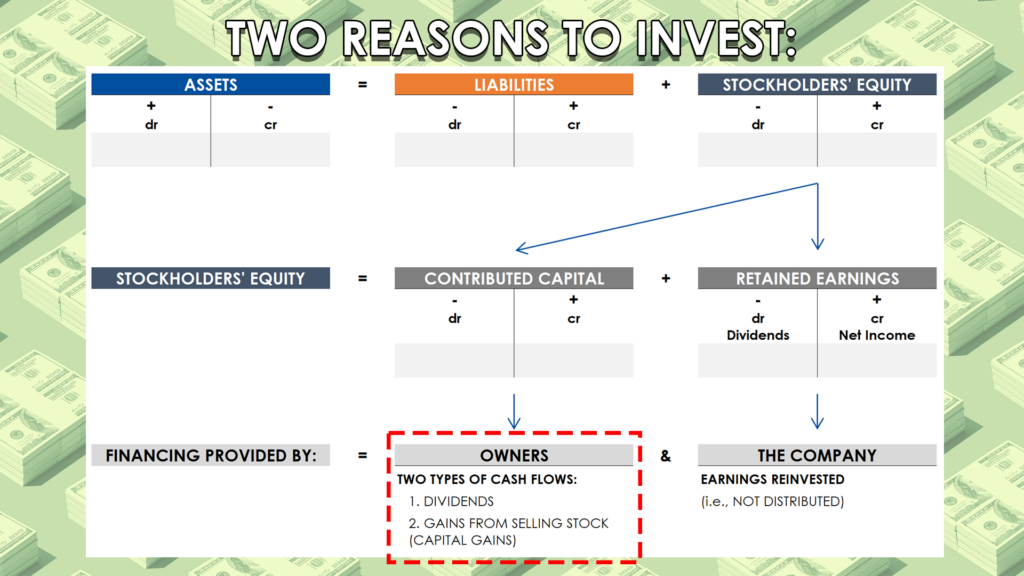

Investors invest for two reasons, capital gains (or selling the stock at a higher price in the future) and dividends. The best way to make sure you get one or the other is cash flow.

If the company never stops bleeding and continues to lose users, the cash on the balance sheet won’t matter. And if that’s the only reason you invested, you’ll be sorely disappointed.