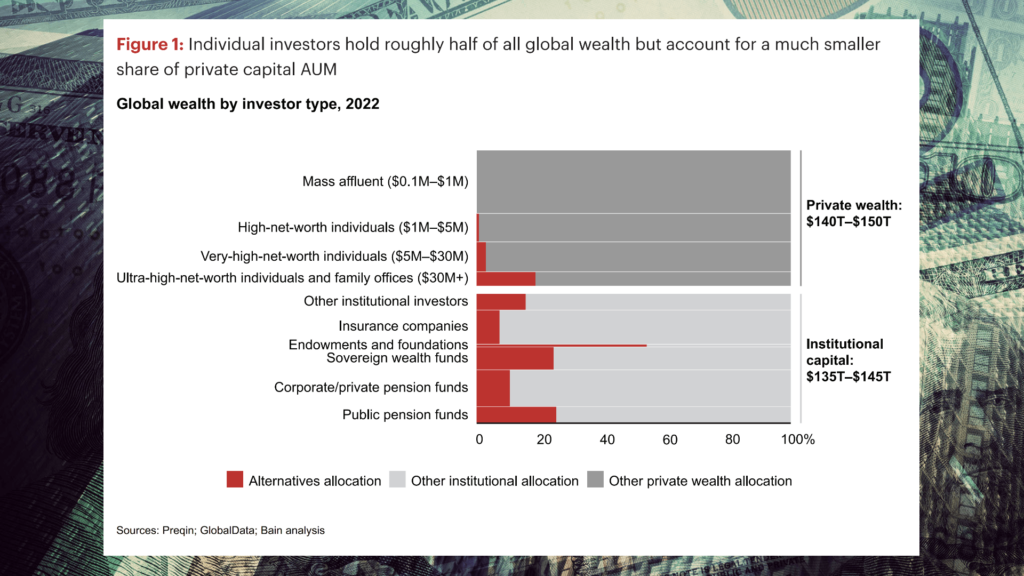

There are ~$285 trillion worth of assets under management on planet earth. Who do you think holds the bigger slice of this pie, individuals or institutions? Surprisingly, the split is close to equal. But while individual investors hold half of all investments, they only hold 16% of capital allocated to alternative strategies such as private equity (PE).

Source: Bain & Company’s Global Private Equity Report 2023 (Background Added)

Source: Bain & Company’s Global Private Equity Report 2023 (Background Added)

That is changing, according to a report from Bain Capital. PE funds are now trying to attract money from smaller investors than they have traditionally worked with. And many such individuals are anxious to buy into the PE party. These funds offer options for return and diversification that the retail market has never had. Furthermore, middlemen are busy developing regulation-compliant technologies and platforms to help bring the two sides together.

Assuming the trend continues, will private equity hooking up with a larger “public” produce an attractive investment alternative? What should individuals interested in this opportunity know before diving in?

Why Private Equity is Chasing Wealthy Individuals

From the point of view of PE managers, this is the deal: The flow of money from institutional clients seems to be leveling off. Bain’s report forecasts 8% annual growth in institutional investment in alternative funds for the next decade. Over the same period, individual wealth invested in alternatives is expected to grow by 12% annually.

This means individuals are a huge (in the aggregate) untapped resource from which PE funds can collect fees for assets under management. These management fees typically range from 1.5% to 2% of committed capital. Originally thought of as a “keep the lights on” fee, they have become a meaningful source of revenue for PE partnerships.

As this source of revenue has expanded, it has also become an investment opportunity in and of itself. More precisely, fees are enticing to investors who want to buy directly into PE general partnerships themselves (rather than the underlying funds), an activity called GP-stakes investing. Through a GP stake, an investor takes partial ownership of the private equity firm’s business model, which includes the management fee. This differs from a traditional private equity fund investment, in which gains come only from the performance of the firm’s portfolio of companies. Though small as a percentage, management fees are steadier than the “lumpy” gains a partnership realizes from acquiring and eventually selling the companies in its portfolio. But whether due to GP-stakes investing or a push into individual markets, a rising focus on fees could have a downside.

Traditionally, capital gains have made the PE world go ‘round. Tweaking this business model may produce unintended consequences, even leading funds to compete on fees and lose focus on their bread-and-butter work of capital gains.

Nonetheless, the largest players in the private asset space seem committed to entering retail markets. Blackstone and KKR are both developing and launching alternative funds open to individual capital. Apollo, Constitution Capital and Blue Owl are also implementing retail-oriented strategies.

It won’t be easy. Attracting and then dealing with large numbers of (relatively) small investors will bring a steep learning curve for PE managers. For instance, marketing and customer service will be a whole new beast. And once on board, individuals tend to be impatient when they decide to cash out. PE managers will have to learn how to set liquidity expectations among individual investors, ones that will square with the illiquid nature of private equity.

So far this isn’t dissuading PE firms from forging ahead. And for their part, many individuals are ready for new investment options. The Bain report notes that in the past twenty-five years, the number of public companies in the U.S. has decreased by roughly one-third. And the universe of remaining public companies is ever more tech heavy. In other words, the public opportunity set is shrinking, making private equity increasingly attractive.

How Middlemen Are Helping Private Equity and Individuals Get Together

PE managers want individual investors. Individuals want to invest in PE. Getting together, then, should be simple, right? Not so much. For one thing, as PE managers market to lower levels of the individual market, existing regulations complicate the relationship. But there has been some change on this front as well.

In 2020 the Securities and Exchange Commission amended (“modernized,” per the SEC’s own statement) the criteria to be considered an “accredited investor.” These are investors eligible to invest in private, non-regulated assets like private equity. The criteria now allows for consideration of a person’s level of financial knowledge, not just their net worth and income.

The other complication, which I mentioned above, is liquidity. PE is by nature an illiquid enterprise. It takes time to identify companies for acquisition, scale and then sell them for a profit. Investors can throw a major monkey wrench into the works if they, for instance, demand large withdrawals because they want to take a dream vacation or pay for a child’s lavish wedding. Blackrock has already had to deal with this very issue in one of its alternative retail funds, BREIT. In 2022, BREIT investors made nervous by market volatility had to be strictly reminded of the fund’s withdrawal rules (maximum of 2% per month and 5% per quarter).

Apart from educating investors, work is being done by middlemen such as Moonfare and Securitize to create more liquidity. They have developed platforms that not only provide individual investors access to alternative funds, but also provide a limited secondary market in which they can buy and sell their stakes. This may never offer the same level of liquidity as a public exchange, but it’s an important step for opening the individual market to PE funds.

Tiered Fee Structures: All Private Equity Investors Are Not Created Equal

In the world of fund raising, there have always been incentives to encourage investors to act quickly and amply. So called private equity “side letters” are used to offer special rights to certain investors and limited partners, even providing them with favorable fee exposure.

How might this impact individuals? In a recent conversation with a fund manager, I learned that they had started using crowd-funding platforms to raise capital from individuals on one fee structure while “filling the gap” with a large institutional investor on a more favorable fee structure.

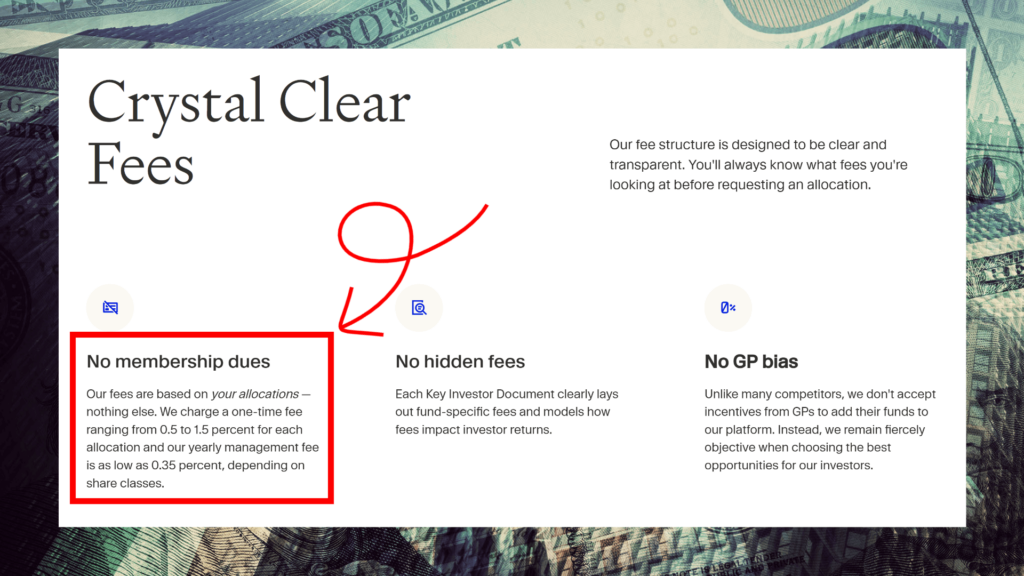

This means that individuals need to be aware of both tiered management fee structures and fees they must pay for access. For example, Moonfare’s website cites both a “one-time fee ranging from 0.5 to 1.5 percent for each allocation, and a yearly management fee as low as 0.35 percent, depending on share classes.”

Source: Moonfare’s Direct Investments Landing Page (Background and Colored Arrows Added)

Source: Moonfare’s Direct Investments Landing Page (Background and Colored Arrows Added)

Investing in private equity is not easy. Each transaction requires substantial documentation. So, I am not saying additional fees are unwarranted, but that investors should educate themselves on what is acceptable.

On a personal note, I have always worked to invest directly at the company level or at the fund level. I have not previously used any of these platforms, and I would encourage investors to explore performance net of fees before proceeding. The process of identifying direct investments or funds open for investment requires a lot of networking, and I realize that a lot of people do not make time for that. So I thought it would be interesting to start exploring more accessible means of participating in private equity.

Conclusion

The trend of opening private equity to individual investors is being pushed on three fronts (PE funds, individuals, middlemen). So it’s a near-sure bet that the trend will continue. Before testing the waters, individuals should take the time to educate themselves on how PE works, making sure they understand both liquidity requirements and fee structures for any funds they are considering taking part in.