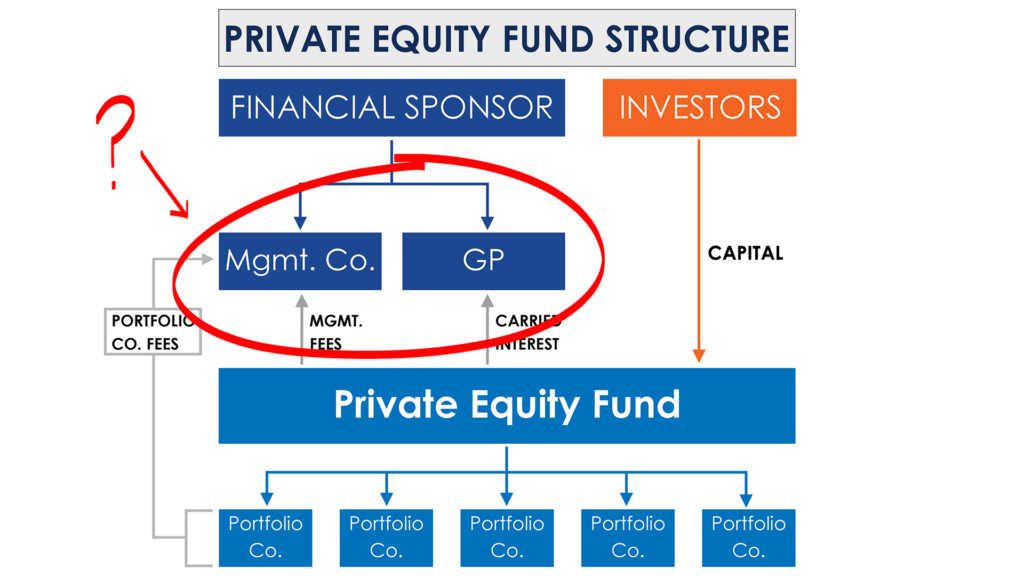

Why does a private equity fund have both a general partner and a management company? In the lesson titled Private Equity Fund Structure, which is available as part of the Private Equity Training curriculum at ASM, the financial sponsor is defined as follows (please refer to the image below for a visual).

Financial Sponsor (“Sponsor” in image): The team of individuals that will identify, execute and manage investments in privately held operating businesses. This is generally comprised of a General Partner and a Management Company.

- General Partner (GP): The entity with the legal authority to make decisions for the fund. This entity also assumes all legal liability.

- Management Company (aka fund manager, investment advisor): The operating entity that employs the investment professionals responsible for allocating capital and managing investments.

The management company is generally affiliated with the GP, but they are not the same entity. The GP will enter into a management agreement (or investment advisory agreement) with the management company. Under this agreement the fund pays the management company fees to employ the investment team, evaluate opportunities, manage the portfolio, and manage all day-to-day operations.

This is a common structure that allows the management company to work across multiple funds while still having a GP for each fund. It is not uncommon to see a private equity firm scale and raise new funds in the process. Over time the same management company could be affiliated with a handful of funds (GPs).

The management company owns the firms branded assets and intellectual property, which include the name of the firm, the track record and any proprietary processes the firm has developed. This helps the management company raise new funds and allows it to build goodwill across funds.

Private Equity Management Company Example

Let’s dive into a specific example to demonstrate why this is so valuable. I met with the partner of a large, NYC-based private equity fund with more than $20 billion of assets under management, and he told me that they employ an operations team of 55 people to help their portfolio investments. All of these talented individuals are employed by the management company, and they help portfolio companies across multiple funds.

The partner I was talking to told me they will not get involved if they have to replace the management team. They are looking for solid companies with strong management teams. But even excellent management teams can use a little extra horsepower and bandwidth sometimes. If a portfolio company wants to explore a transaction, for example, and the executive team is tied up with current initiatives, the private equity firm can step in with its small army of analysts and operators to accelerate the process.

Now you need a lot of fees to pull this off. With $20 billion of AUM and assuming a management fee of 1.5%, the PE firm can count on $300 million in management fees each year. It’s an incredible resource, and it’s also a selling point when they approach a new investment opportunity and when they are raising new funds because they have a track record that they can point to of helping great companies outperform their peers.

I think it’s important to emphasize the value this carries when a firm is raising capital. Think about the additional comfort an investor feels when they know the fund they are investing in has a management company with deep resources attached to it versus the confidence an investor has to have in a first-time fund with no background or history of success.

As a private equity firm scales, this structure allows the management company to work across multiple funds while still having a GP for each fund. Over time the same management company could be affiliated with a handful of funds.

In summary, each new fund must have its own general partner, but the accumulation of knowledge and processes resides in the management company providing the private equity firm with economies of scale.

For more context please see the video titled Private Equity Fund Structure (available below).

Learn more about private equity transactions with ASM’s Private Equity Training course. The Private Equity Training course was developed by industry professionals. The content goes beyond the LBO model to explain how private equity professionals source, structure and close transactions.