Note: I thought it would be a good idea to start posting answers to questions I receive via email. I try to answer all of them but occasionally my job gets in the way…

This question refers to the video titled “Integrating Financial Statements.”

In the model it is difficult to understand the need for a minimum cash balance because we are projecting the financial statements of a fictional business. But the minimum cash balance would be maintained by the company’s management team to avoid shortfalls resulting from differences in cash inflows and cash outflows. This is a bit abstract so I thought I would attempt to provide some context…

Consider the following: Let’s say you own a business subject to seasonality. Your company manufactures inflatable pool toys. More precisely, alligator pool floats. Every year your sales start to trend higher in April and May as customers get ready for summer. Anticipating this need you increase purchases of raw material (inventory) in the first quarter, which consumes cash.

Now that you have purchased the raw material and started manufacturing in anticipation of greater sales, consider a scenario where a summer blockbuster is released depicting alligators as evil – like “JAWS” but now you’re not safe anywhere (because they have legs). As a result everyone is terrified of alligators, even inflatable ones, and sales drop below expectations. With a large percentage of your cash tied up in inventory, and sales trickling in, you will still require cash to cover expenses (salaries, rent, etc) until sales resume.

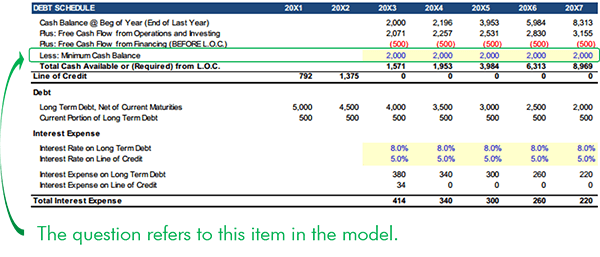

If you want to show this in the model, assume that the periods are months instead of years and increase Inventory Days from period to period, but keep sales constant. To reflect declining sales you could also reduce revenue in each period. What you will see in the model is that the revolver (line of credit) grows to compensate for the cash shortfall. In reality, however, a limit would be imposed on credit available through the revolver (imposed by the lender), and once this is exhausted you will have to rely on cash. Modeling several scenarios and deciding which are likely helps establish the minimum cash balance to maintain at all times.

If that is too specific… it’s wise to keep cash on hand (and/or access to line of credit) to manage fluctuations in working capital, unpredictable sales and to survive disasters (other needs exist, but my attempt to keep this short is failing…). As a responsible manager you would attempt to predict what these anticipated or unanticipated cash needs might be, and maintain appropriate levels of cash for those scenarios.

Finally, if you are looking for a metric to answer this question, it is not uncommon to hear the cash need (or line of credit need) referred to as a number of days of sales.