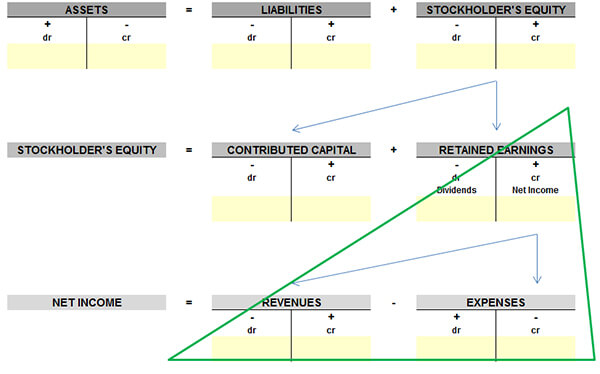

Q: If net income is $10 for four months, retained earnings grows by $10 each month. However, if dividends were paid out in the second month, would net income equal the change in retained earnings over the four month period less the dividend?

A: The statement of retained earnings is affected by any transaction that affects net income and dividends.

Starting with net income:

Retained earnings will grow by net income in each period. So if net income is $10 in one month retained earnings will grow by $10 that same month. If over four months net income is $10 each month retained earnings will grow by $10 each month or $40 over the four month period.

Dividends:

Retained earnings must also reflect any dividends paid out in that period. For example, if for any period you had a beginning balance for retained earnings of $100, and in that period recorded net income of $10 and paid dividends of $5:

Retained Earnings = $100 + $10 – $5 = $105

Net income, however, is not impacted by dividends.

The balance sheet remains balanced (Assets = Liabilities + Stockholders’ Equity) by reducing cash by the same amount paid out in dividends. This works because your cash flow statement starts with net income at the top, and then makes adjustments to net income to arrive at cash flow for that period at the bottom. One of those adjustments is the payment of dividends (made under cash flow from financing activities). The cash flow calculated on the cash flow statement is the sum that grows your cash balance on the balance sheet. So on your balance sheet both cash and retained earnings get reduced by the dividends paid out.

IMAGE: screencap from the video titled Income Statement.