In this post we will cover a simple debt recapitalization in a three-statement model. This is a continuation of the post titled “Adding a Loan to a Three Statement Model,” and relies on the same workbook, which can be downloaded here.

This post does not include the financing fee related to the new debt raise, but there are two worksheets in the workbook that explain the treatment of financing fees in a financial model. This post breaks down the process of updating a three-statement model for a debt recapitalization into two steps outlined below in bold text.

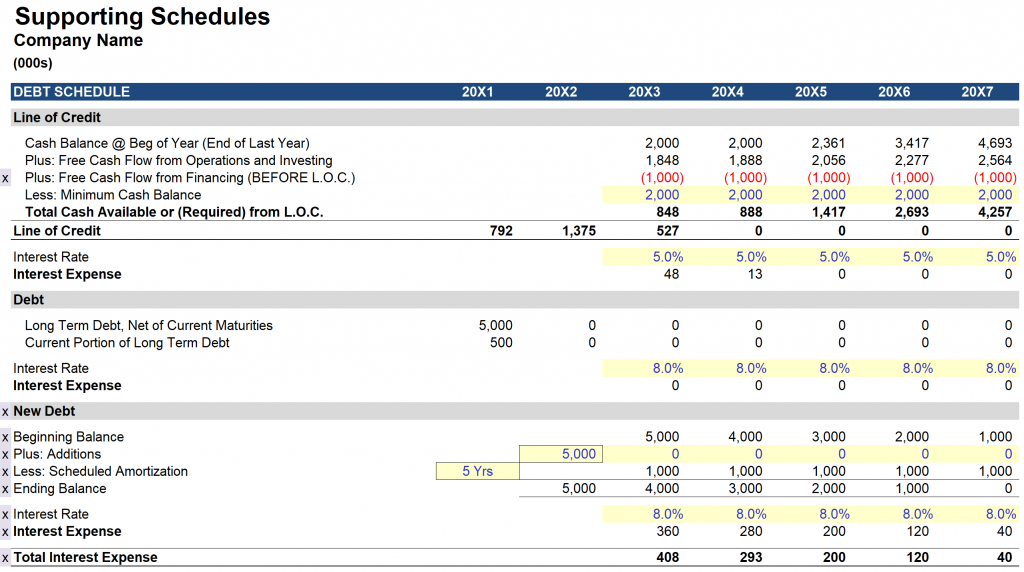

Update the Debt Schedule for this New Debt Issuance.

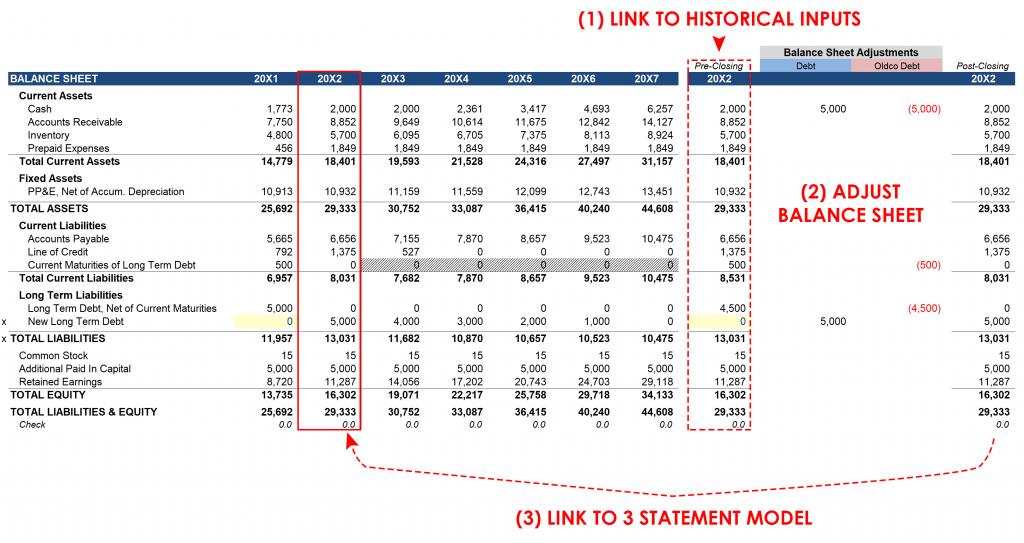

In this example we will be raising the exact same amount of capital as the business has outstanding at the time of the debt recapitalization. Changes are indicated by a small x on the left-hand side of the image.

Add the Balance Sheet Adjustments.

Step two requires making an adjustment to the balance sheet in the transaction period (20X2). The Excel file may appear intimidating, but the process is simple. To adjust the balance sheet for the change in capital structure complete the steps that follow. Please refer to the image below the bulleted list.

- Link the historical values to the column marked by a rectangle with a red-dashed line.

- Input the balance sheet adjustments visible under the columns titled “Debt” and “Oldco Debt.” The values under “Debt” (indicated with a light blue shaded header) link to the new debt schedule. The values under “Oldco Debt” link directly to the pre-closing balance sheet; the only difference is that the values are now negative.

- Link the post-closing balance sheet back to the model.

You will notice that the oldco debt balances have been zeroed out, and that only “New Long Term Debt” remains as a long term liability on the balance sheet in the projected period. The elimination of “Current Maturities of Long Term Debt” is expained under “Additional Commentary” below.

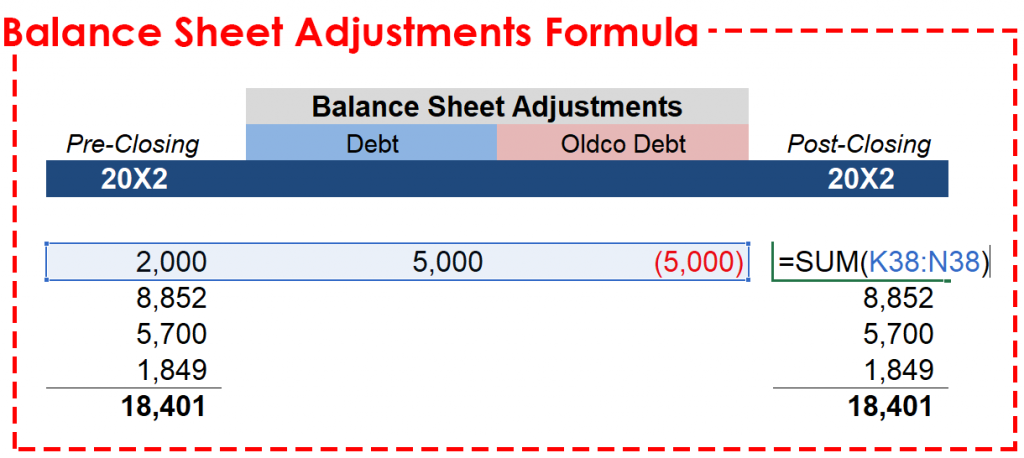

In step 2 above the =SUM() function is used to calculate the post-closing balance sheet. The formula is visible in the image below.

ADDITIONAL COMMENTARY:

Current Maturities of Long-Term Debt: In this model, and in most LBO Models, the current portion of long term debt is not listed as a current liability. Instead the entire debt balance is listed under Long Term Liabilities. This makes the model easier to work with as the capital structure expands to include additional debt tranches.

Dividends: In this debt recapitalization we are using the new debt issuance to retire the old debt balance. This post will not include a dividend, but you can explore how a dividend payment would then be made by visiting this post.