If you are thinking about a career in private credit, you have good timing. The field is booming right now, with average entry-level compensation exceeding that of private equity. According to this report from human resources firm Selby Jennings, associates at private credit funds are earning $250,000-$350,000 annually in total compensation, compared to $180,000-$280,000 for similar positions at middle-market PE funds.

With that said, as an asset class, private credit’s long-term returns are still less, on average, than private equity, something we mentioned in the previous post (link to private credit vs private equity post). For that reason, overall performance-based compensation for senior employees in private credit remains significantly lower than in private equity. This is especially true after accounting for carried interest (or simply, “carry”)—deal profits distributed to general partners at PE funds.

In terms of day-to-day work, life at a private credit fund can vary considerably depending on whether the fund originates its loans, purchases them in secondary markets, or both. Regardless, regular tasks are often more comparable to those at a hedge fund than a PE fund, because most debt funds lack a controlling interest in the businesses they are invested in. And since private equity is what we most often talk about here at ASM, in this—the last of our three-post series on private credit (link to first post)—we explore life in the space in terms of its contrasts with private equity.

Differences in Working in Private Credit vs. Private Equity

1. Exposure to More Companies and Industries

Private equity associates do not typically work more than 3-4 deals in a significant way at one time. And when a deal advances, that number quickly dwindles to one. But on the credit side, it is not uncommon for a single associate to be looking at dozens of investments at once. This has to do with the fact that private credit funds make both smaller and more investments, on average, than private equity funds. An average PE fund’s portfolio will contain only 10-20 companies at one time [1], whereas even a more concentrated private credit fund may hold 30-60 positions at a time [2], with meaningful velocity in terms of how those investments turn over. There also tends to be less industry specialization in private credit than in private equity, where even at the associate level it is increasingly common to be assigned to a single sector.

2. More Diligence, Less Portfolio Work

With the exception of distressed and special situation funds, which may invest with an eye toward gaining control of a business, most credit fund professionals spend the vast majority of their time diligencing new investments. When everything is going well at a credit fund, the existing investments should be essentially servicing themselves (in that interest payments are hitting bank accounts on time and as expected). By way of contrast, private equity professionals can easily spend the majority of their time on portfolio work as they try to help portcos improve their operations and profitability.

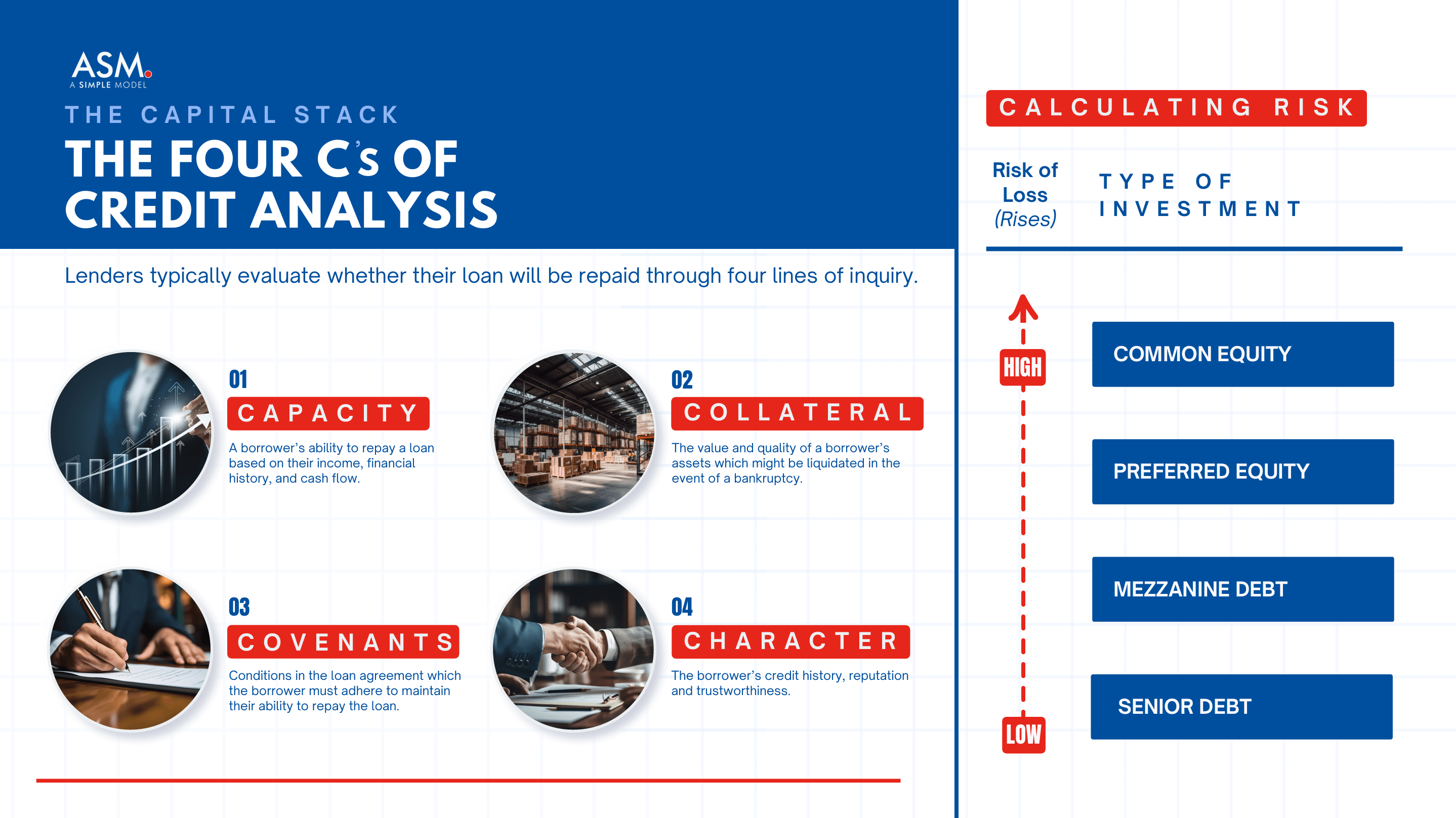

3. Less In-Depth Modeling

Diligence is not the same animal in private credit as in private equity. With credit funds generally taking smaller, non-control positions in businesses, the diligence on each investment is not as significant, and the financial modeling involved is not as complex, since there is little need to understand the full upside potential of the underlying business in detail. All that really matters at a high level is the cost to acquire the debt, the repayment terms and whether the business can support them (a matter of credit analysis, see Figure 1 below), as well as in some cases basic modeling of default scenarios. Though it varies based on factors such as whether a fund is actually originating loans or just purchasing them (with the former being much more involved), a private credit investor might progress from looking at a deal to being invested in under a week. In private equity, that timeline would be at least 3-4 months, and often longer.

Figure 1. The Four Cs of Credit Analysis: Lenders typically evaluate whether their loan will be repaid through four lines of inquiry.

Many people in credit investing come from legal backgrounds, so it is no surprise that day-to-day work at private credit funds can involve a tremendous amount of reading. Private equity investors are obviously very involved in drafting and reviewing purchase agreements when they acquire a business, but that typically does not happen more than once or twice a year. Credit investors review many more deals than that. And credit agreements can sometimes run over 1,000 pages (that’s not a mis-print), which must be carefully reviewed to parse key items such as:

- Amount and schedule of fees (if originating the loan) and interest payments

- Repayment conditions

- Collateral and seniority

- Covenants and reporting requirements

- Default provisions and remedies

Some credit funds have become notorious for waging contentious battles—sometimes in court—over obscure interpretations of credit agreement clauses. For example, Peter once worked a deal that nearly fell apart (https://www.asimplemodel.com/insights/intercreditor-agreement-overview) because of a feud between creditors over a single number in a Subordination and Intercreditor Agreement.

5. Less People-Facing Work

Private equity diligence, being so in-depth, tends to require larger teams and more collaboration than is typical in credit diligence, which can involve significant solitary work (though there will still be presentations to an investment committee for approval and occasional consultations with outside experts). In general, private equity involves quite a bit more “people-facing” work in terms of dealing with management teams, consultants, boards, etc., whereas private credit (in no small part because of the diligence focus mentioned above) is more engaged with individual modeling and reading of documents.

But there are also exceptions to this rule, especially in funds that place associates into more specialized roles. For example, take a look at this ASM interview of Ryan Mullins at Elm Park Capital, a private credit fund where Ryan fills a dedicated business development role. “You’re going to spend a lot of your day on the phone talking to people,” he said in describing his job, “or trying to go meet with people in person.” The interview includes information on what credit funds look for when hiring associates to focus on business development.

Private Credit or Private Equity: Which Space is for You?

There you have it, the differences between working in private credit and private equity. But what if you still can’t decide which is for you? Should you work in both simultaneously? Probably not if you like to sleep. But there is another possibility. As I mentioned above, there are firms that operate somewhat at the intersection of private credit and private equity, in that they take significant positions in the debt of distressed companies. They may gain board representation and sometimes convert their debt into equity and assume control (“loan to own” strategies), helping to run the business after a default or restructuring. This approach to credit investing now exists as an alternative strategy at private equity juggernauts such as Bain, Blackstone, Oaktree, and others. In such cases, the private “credit” becomes more than just money, it becomes a relationship between borrower and lender centered around operationally improving the business.

If you are up for some serious extra-credit work on this topic (the kind that would definitely impress an interviewer), check out this paper (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4635056) by Narine Lalafaryan, a law professor at Cambridge. She argues that with the growth of private credit in recent years, the line between debt and equity is actually starting to blur. “Maybe it should [all] be called just capital,” she writes. Lalafaryan makes a fascinating point. But in practical terms, there will remain key differences between debt and equity. And with the private credit space growing rapidly, look for us to cover more on its ins and outs in future posts.

Links to Sources:

- [1] Link: https://uncipc.org/wp-content/uploads/2024/02/LossAvoidance_Feb-1-2024.pdf

- [2] Link: https://www.gsam.com/content/gsam/global/en/market-insights/gsam-insights/perspectives/2023/building-private-credit-portfolios.html