“A leader,” writes John C. Maxwell, “is one who knows the way, goes the way, and shows the way.” It’s a powerful quote and one that sums up a lot of what it takes to be a great C-suite executive. In this post, I want to talk a bit more about what makes executives great, focusing specifically on those who manage private equity portfolio companies (“portcos”). Strong leaders exhibit certain universal characteristics in virtually any context, of course, but exceptional portco executives tend to be a unique and highly sought after breed.

Bain Capital’s 2024 global private equity report finds that in 2023, PE buyout funds owned some 28,000 companies representing $3.2 trillion in unrealized value globally. Both figures are all-time records. All of these un-exited portcos need leadership, and the demand for good executives to fill the slots is not only increasing, but in many cases far outstripping the available supply. Exacerbating the problem, there is too often an exodus of executives after a company is acquired by private equity. A recent article in the Harvard Business Review reports that three out of four CEOs leave a business post-acquisition, with over half (54%) of these being unplanned-for departures that happen within the two years after acquisition. Such turnover can depress returns and lengthen hold periods for the PE firm. The article’s recommendation is for the private equity industry to invest in “a new talent strategy” by developing a ready supply of skilled leaders.

Below, I’ll summarize some of the characteristics that set these skilled leaders apart, which should hopefully be a helpful reference both for executives exploring a partnership with private equity and investors searching for the right portco leaders.

The Attributes of Great PE Portco Executives

As an interesting jumping off point, the Harvard Business Review article mentioned above surveyed and quantified the personality traits of portco executives, as contrasted with their PE firm counterparts. The latter, not surprisingly, tended to be “dealmakers” who valued charismatic leadership traits. Portco executives, on the other hand, were more practical, describing leadership as a “team sport.” Portco executives were 20% more likely than PE firm executives to value collaboration, and more than twice as likely to emphasize relationship building and talent development, perhaps suggesting that this is a valuable offset to a board full of PE dealmakers.

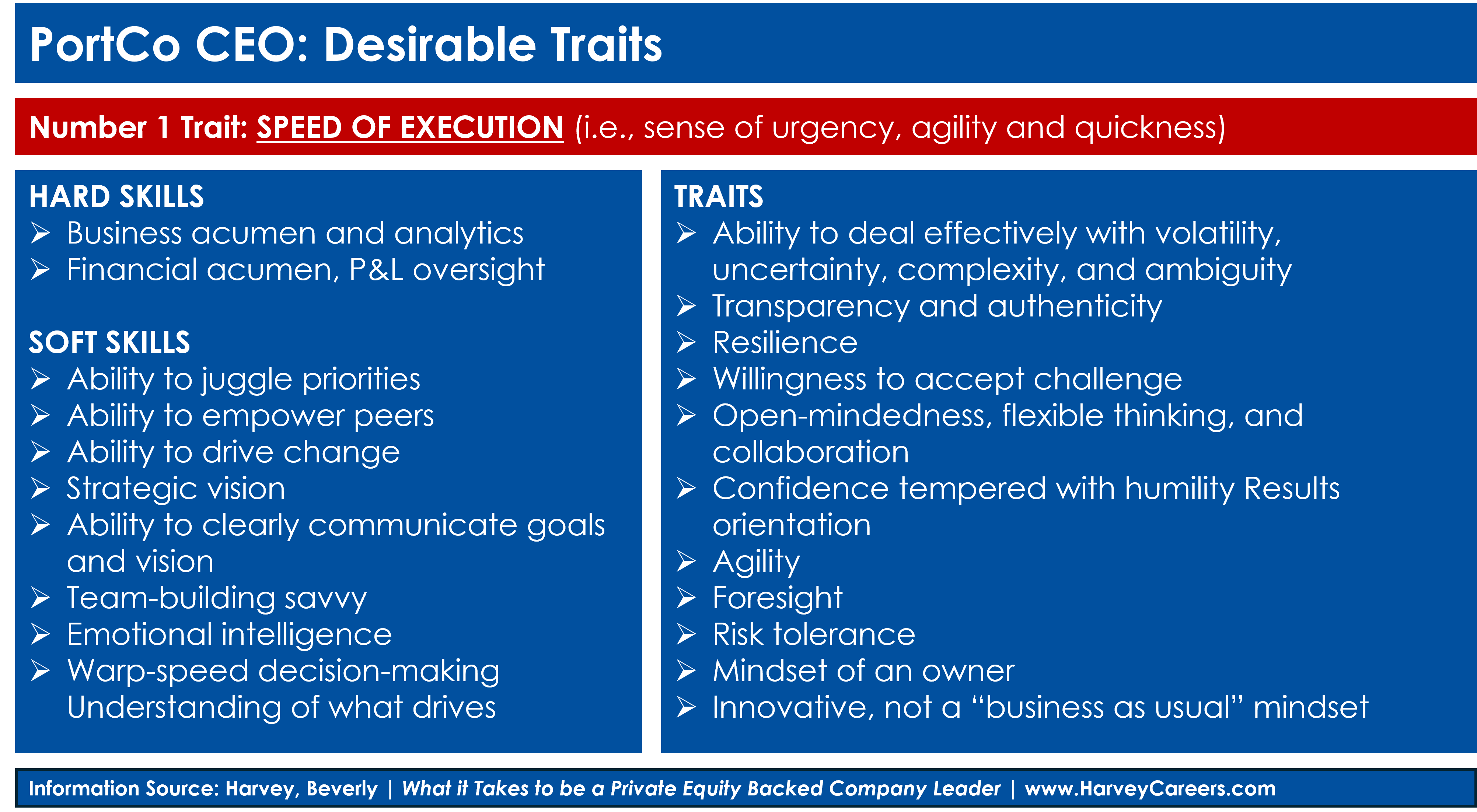

Another report, from HarveyCareers, divides the general personality traits of successful portco CEOs into three categories (hard skills, soft skills, and personality traits), as captured in the table below.

Apart from these broad characteristics, the eight attributes below tend to be highly present in portco executives who are not just competent managers, but exceptional leaders and value drivers for the investments they steward.

Financially Savvy & Metrics Driven: Portco executives, especially CEOs, must live in the finances more than their public-company peers, keeping a finger on the financial pulse of their firm while quickly detecting and responding to changes in its rhythm. Understanding cash flow (subscriber content) is critical to this, and optimizing cash flow requires capital deployment that is not only purposeful but surgical. And beyond the strictly financial realm, a data-driven approach to guiding business operations through dashboards, benchmarking, and other monitoring techniques—in something close to real time—is also important. If this sounds like a great executive must be a dyed-in-the-wool quant, that’s not the case at all. One simply needs to embody a combination of both quantitative and qualitative management, which is one reason the great ones are in such short supply.

Entrepreneurially Minded: The best portco leaders tend to have an extremely entrepreneurial mindset, even if they have technically never been an entrepreneur. They are hands-on doers with the flexibility to wear whatever “hat” a situation calls for. Such leaders often structure their organizations in a flat, lean manner to accomplish more with fewer resources, while staffing them with similarly flexible “all sport athletes” who can fill different roles as circumstances change. Additionally, they tend to be very comfortable with performance-based compensation, much as a startup founder would be. Performance-based compensation is used extensively in the PE world to align incentives between portco management and the fund’s investors, so that both win big when the business does well (or suffer together if it doesn’t). Time- and performance-based options in particular are common, as is a requirement to reinvest a substantial amount of profits from a prior sale if the executive is staying on at an acquired company.

Fast Moving & Action-Oriented: More than most industries, private equity runs on defined timelines for delivering results. And while these have been lengthening in recent years, portco leaders must still be able to execute decisions and produce results quickly. As this McKinsey report notes, “Typical CEOs look at their calendars…portfolio-company CEOs look at their watches.” More than anything, being in this PE time warp requires not letting the perfect be the enemy of the good (or, sometimes, even the “good enough”). If you can achieve 80% of a goal with 20% of the work, that’s gold in the PE world.

Focused Visionaries Who Thrive Under Constraint: This is a key difference between leaders of PE-backed businesses and businesses in general. Both must be visionaries. But while the latter may dream up their firm’s strategic plan almost whole-cloth, the former step into a plan that is somewhat predetermined by the fund’s investment thesis. Success in this environment of “constrained optimization” usually requires identifying the 3-4 highest priority value-creation levers, then focusing ruthlessly on them (while inspiring the rest of the organization to do the same) to make the plan a reality.

Exceptional Team Builders: PE acquisitions begin like ensemble superhero movies—with the assembling of a team. This is especially true in carve-out and roll-up plays, where a standalone team may not even exist before acquisition. The PE firm’s dealmakers want to identify and install the best group possible, but often lack time to manage the task themselves. Having a CEO, or better yet an entire C-suite, that can quickly fill out a firm’s junior leadership ranks with a cast worthy of a Justice League film is a huge advantage in hitting the ground running. This report from SpencerStuart quotes Paul Nardone, an operating partner at Sherbrooke Capital, as saying that this is not a time to think frugally: “You certainly have to think big and think aggressively (in selecting a team) when a private equity group is involved in your business, because that’s what they want you to do.”

Agile Leaders at Ease in “VUCA” Environments: Private equity is not what you would call a staid and static field. Businesses under PE ownership are in a constant state of flux almost by default, as owners and managers implement aggressive value-creation plans. With this in mind, great portco executives need to move like an NFL cornerback, pivoting and charting a decisive course through volatile, uncertain, complex, and ambiguous (“VUCA”) environments. Both in their own day-to-day and in how they direct their teams, these executives have to be comfortable with flexible roles and ensuring clear focus and direction and without getting too attached to a stale plan. In effect, this implies being a change manager who can steward an organization and its culture through the rapid upheaval that acquisition by private equity almost always initiates.

Humble, Transparent & Open to Investor Involvement: A portco’s board is often referred to as a “super management team.” Unlike in other corporate contexts, where the CEO may either chair the board or largely direct it, portco C-suites face boards stocked with in-the-know, activist investors who usually have strong ideas about how the business should operate. CEOs accustomed to running their own show may have difficulty adjusting to this. But the best handle it through a combination of strength and humility. Strength keeps them from being “yes men” to the board (something no smart investor wants), while humility lets them embrace the board as a valued partner for achieving business goals. In general, the key to striking this balance is constant, open communication. “[Boards] want to hear about things early, and they want to hear about them often,” Nardone says in the SpencerStuart report. ”I just concluded that this is a true partnership and I’m going to leverage these folks to make all of our jobs a little bit easier.”

Knowledgeable of “The Enemy”: Just kidding on the enemy part, but it is important for a portco executive to understand at least the basics of how private equity investors think and how dealmaking happens in the PE world. Having a background in a specific industry or experience with mergers and acquisitions may also matter, depending on the particular company the executive is running, but this often isn’t make or break. There are also certain strategies, such as turnarounds, in which prior experience is especially helpful, and where funds may look for executives who are already seasoned in these special situations, though this isn’t necessarily the norm outside of these particular niches.

Is Being a Portco Executive in Your Future?

Armed with knowledge of what it takes to be a great portco executive, the key question for current executives is whether you want to become one. It can be an incredibly interesting, fast-paced and dynamic career for those who are the right fit. I’ve seen serial portco executives work well into their 70s, not because they had to, but because they enjoyed the challenge and were so highly courted (and well compensated) by top funds. That suggests a good test for how the position might fit your long-term goals, temperament, and leadership abilities. Does the challenge of working towards big goals under the pressure of tight timelines alongside a smart and demanding set of partners drive and inspire you, or scare you away? And is the thrill of success in that environment something you could see motivating you for decades to come? These are questions, of course, that only you can answer. But more information helps, so we will continue to explore the critical topic of portfolio company leadership more in future posts.