Leveraged Buyout Model

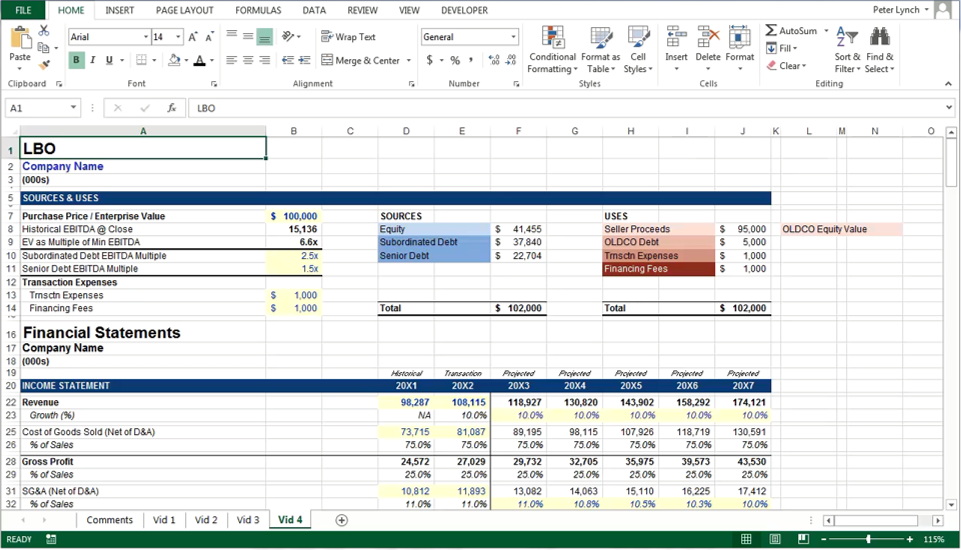

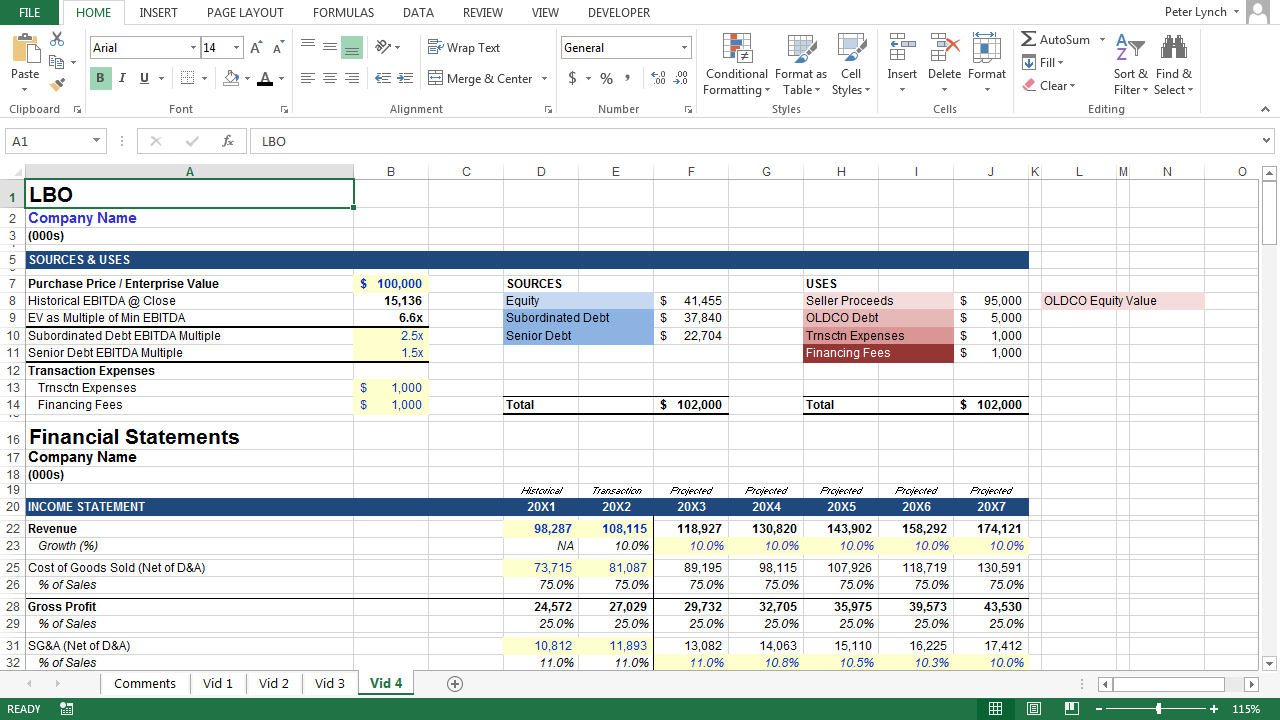

The LBO model is often viewed as extraordinarily complex, but it shouldn’t be. This series will demonstrate that an LBO model is simply a three statement model adjusted to reflect a transaction.

1Dec 23,2013Simple LBO

1Dec 23,2013Simple LBOThis video introduces the LBO model. It starts with an integrated financial statement model and adds the components required for LBO analysis.

2Nov 17,2014Simple LBO: Data Tables

2Nov 17,2014Simple LBO: Data TablesThis video demonstrates the process of running multiple scenarios through your model, and using data tables to view a range of possible outcomes simultaneously.

3Jul 13,2015Simple LBO: Cash Sweep (1 of 2)

3Jul 13,2015Simple LBO: Cash Sweep (1 of 2)This is the first of two videos explaining the cash sweep in a simple LBO model. It requires six quick steps so I chose to capture the process in its entirety. The benefit of an unedited tutorial is that it exposes the small habits and tricks that are otherwise not shared. I hope it makes the material more approachable.

4Mar 22,2016Simple LBO: Cash Sweep (2 of 2)

4Mar 22,2016Simple LBO: Cash Sweep (2 of 2)Whereas the first video focused on the mechanics of adding a cash flow sweep, the second video will describe what is taking place in your model. We will also be including notes that explain how this is dealt with at the company level.

5Jun 14,2016Update to Balance Sheet Adjustments

5Jun 14,2016Update to Balance Sheet AdjustmentsRecently the FASB announced an update that requires a change to the presentation of debt issuance costs in financial statements. While I would argue that the old presentation is superior to this new requirement for most modeling exercises, it is important to be aware of all GAAP standards as you will encounter them reviewing audited financial statements.

6May 21,2019LBO: Multiple Worksheets Approach

6May 21,2019LBO: Multiple Worksheets ApproachIn this video we make the transition from building the model on one worksheet to organizing information on multiple worksheets. As an introduction to this approach, the video focuses on the advantages realized. Per the commentary in the video, the notes associated with this video focus on debt ratio analysis.

7Jul 06,2016LBO: Adding Preferred Stock

7Jul 06,2016LBO: Adding Preferred StockIn this video the process of adding preferred stock to the model is captured in its entirety. Whether it's another debt tranche or class of preferred stock, if you are building your own models this is a common exercise in the life of a financial analyst.

8Aug 18,2016LBO: Cash Sweep Update

8Aug 18,2016LBO: Cash Sweep UpdateWhereas the first video introducing the cash sweep limited optional repayment of debt to senior debt, this video walks through a template with optional repayment toggles for all debt tranches. Financial model available for download.

9May 06,2017LBO: Class B Common Stock

9May 06,2017LBO: Class B Common StockIn this video we start to explore equity structure in greater detail and add Class B Common Stock to the model. The video also provides an overview of private equity fund structure.

10Apr 06,2017LBO: Common + Preferred

10Apr 06,2017LBO: Common + PreferredThis video covers the benefits of including preferred stock in the equity structure of a transaction.

11Jan 09,2020Distribution Waterfall Introduction

11Jan 09,2020Distribution Waterfall IntroductionA standard private equity distribution waterfall is made complicated only by the amount of vocabulary used to describe how it works. The math is otherise simple, as this video demonstrates.

12Aug 06,2020LBO Purchase Price Allocation & Accounting

12Aug 06,2020LBO Purchase Price Allocation & AccountingThe purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control transactions.

13Jun 09,2020LBO Case Study: BabyBurgers LLC

13Jun 09,2020LBO Case Study: BabyBurgers LLCThis case study was developed with the objective of identifying junior team members for a private equity firm. If you are a novice, consider building a simple five-year projection using the summary financials. If you have a more advanced skill-set, you can work with the operating model to build something far more detailed. Best of luck!