Basic Discounted Cash Flow Model

Summary Text

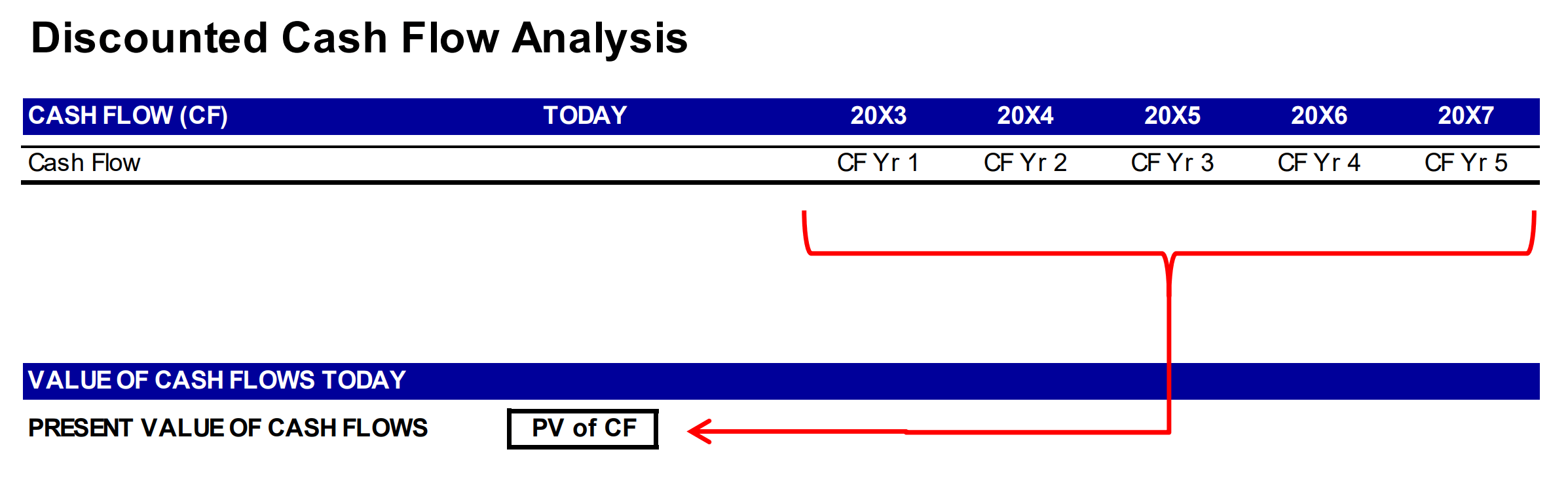

This video opens with an explanation of the objective of a discounted cash flow (“DCF”) model. In DCF analysis, essentially what you are doing is projecting the cash flows of a company, project or asset, and determining the value of those future cash flows today. DCF analysis is focused on the Time Value of Money.

- Time Value of Money: A certain amount of money today has greater buying power today than the same amount of money in the future.

PRESENT VALUE: The value of projected cash flows today.

- Present value is determined by your cost of capital.

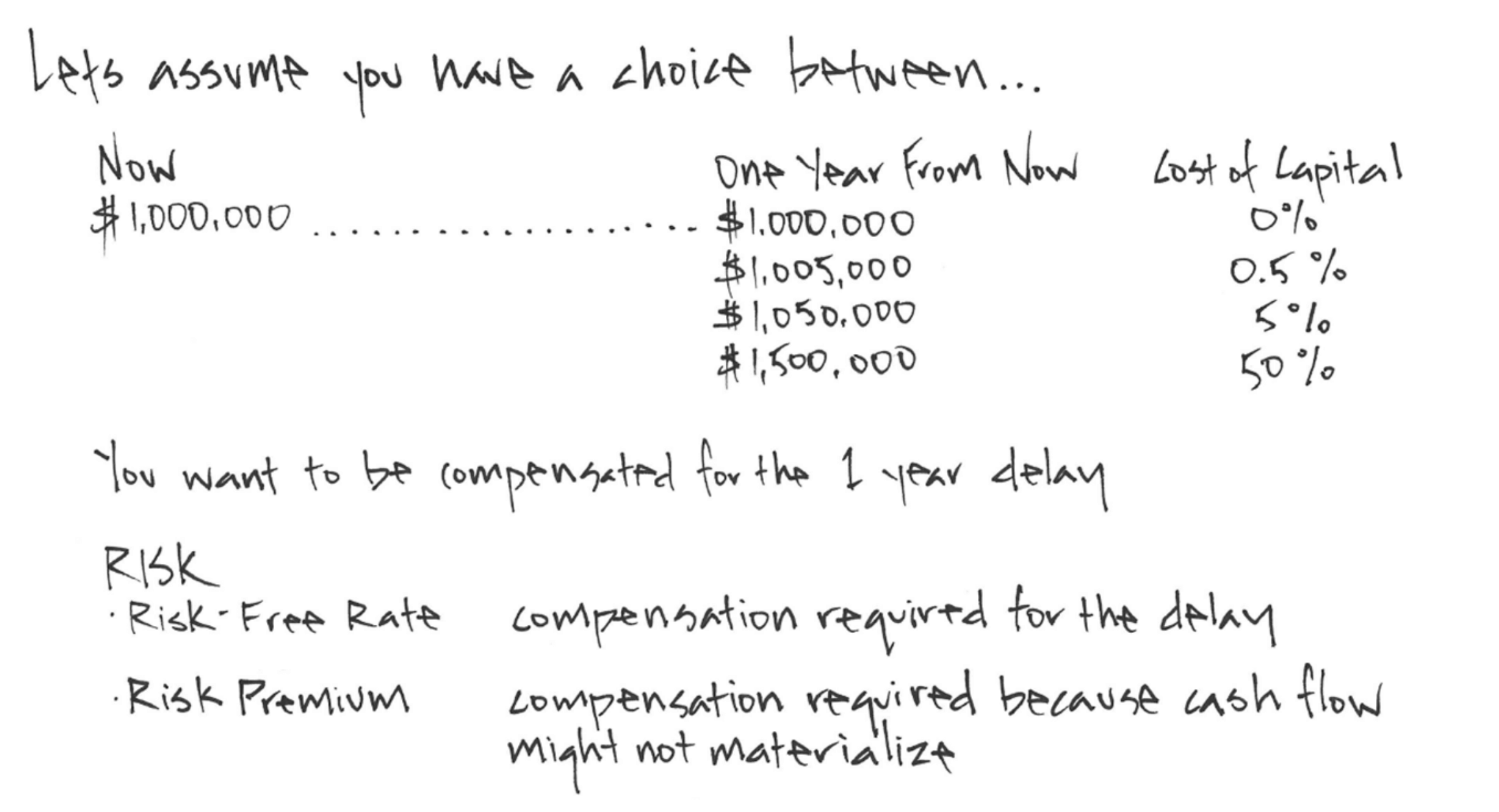

To better illustrate the “cost of capital” concept, the video provides an example in which you are asked to think about the yield you would require to forgo receipt of $1M today, and instead wait one year:

It follows that cost of capital is determined by the yield an investor requires to be compensated for time and risk.

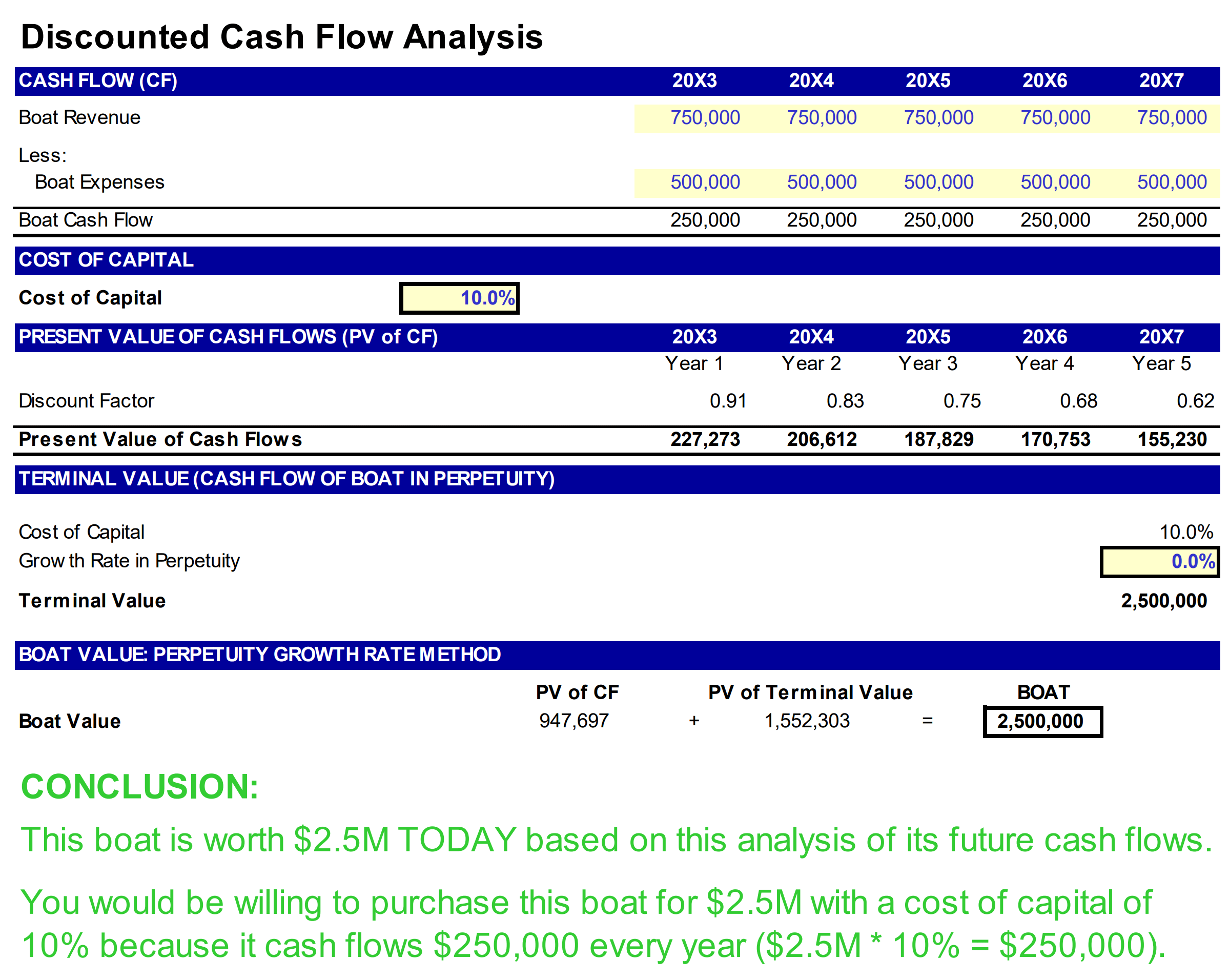

- In this video, to simplify the exercise and focus on the mechanics of building a model, we assume a cost of capital of 10%.

- This cost of capital is applied to the projected cash flows of a boat (asset).

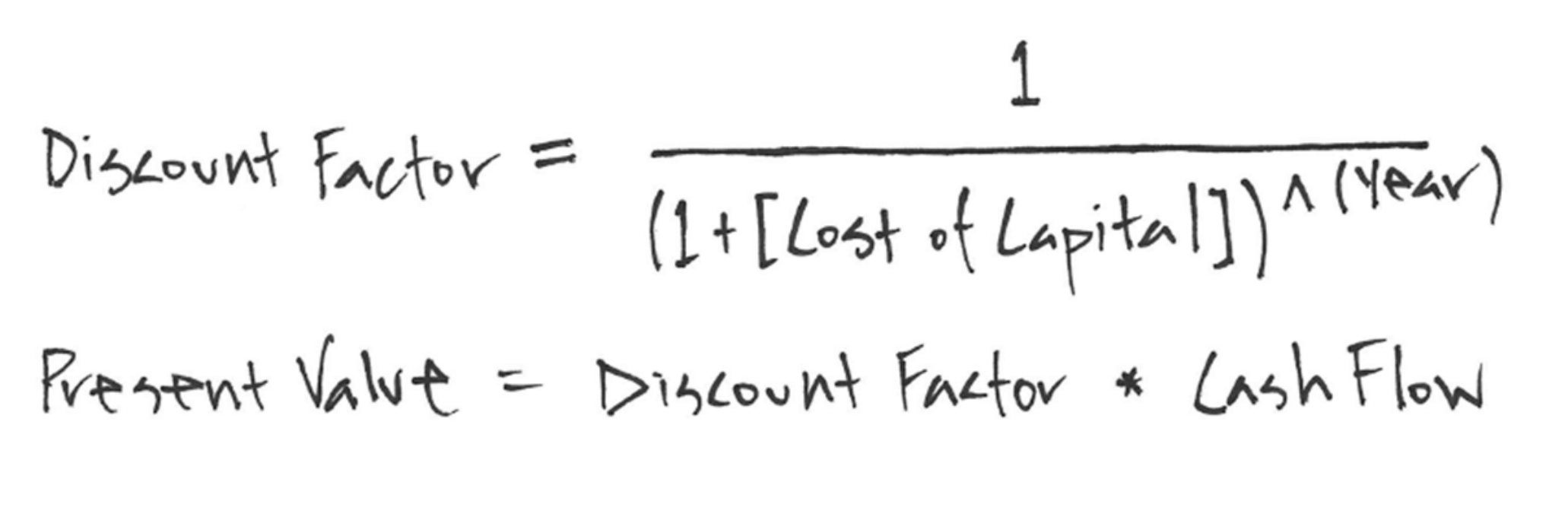

To determine the present value (“PV”) of the projected cash flows the concept of a discount factor is introduced:

- DISCOUNT FACTOR: The calculation used to discount the value of projected cash flows to determine present value.

In the video a highly unrealistic assumption is made: that the cash flows generated by renting a boat to tourists will be consistent year over year. While unrealistic, it makes it easier to see the effect that time has on the value of projected cash flows.

- In the template below you can see the same projected cash flow for each year, and how a 10% cost of capital affects the value of those cash flows in the PV calculation.

- It also makes it easy to demonstrate that the value determined using Terminal Value is equivalent to the value realized if you project the cash flows of the boat far enough in to the future (see video).

POSTED BYASM+ TeamTags:DCF001, Discounted Cash Flow Model, DCF, Financial Modeling