Building a discounted cash flow model (DCF) model introduces some of the most critical aspects of finance including the time value of money, risk and cost of capital. If you intend to pursue a career in finance of any kind, an understanding of how a DCF model works will be highly valuable.

Most concisely, the purpose of a DCF is to project the cash flows of a company, project or asset, and determine the value of those future cash flows in aggregate today. It follows that DCF analysis is focused on the time value of money.

Time Value of Money: A certain amount of money today has greater buying power today than the same amount of money in the future.

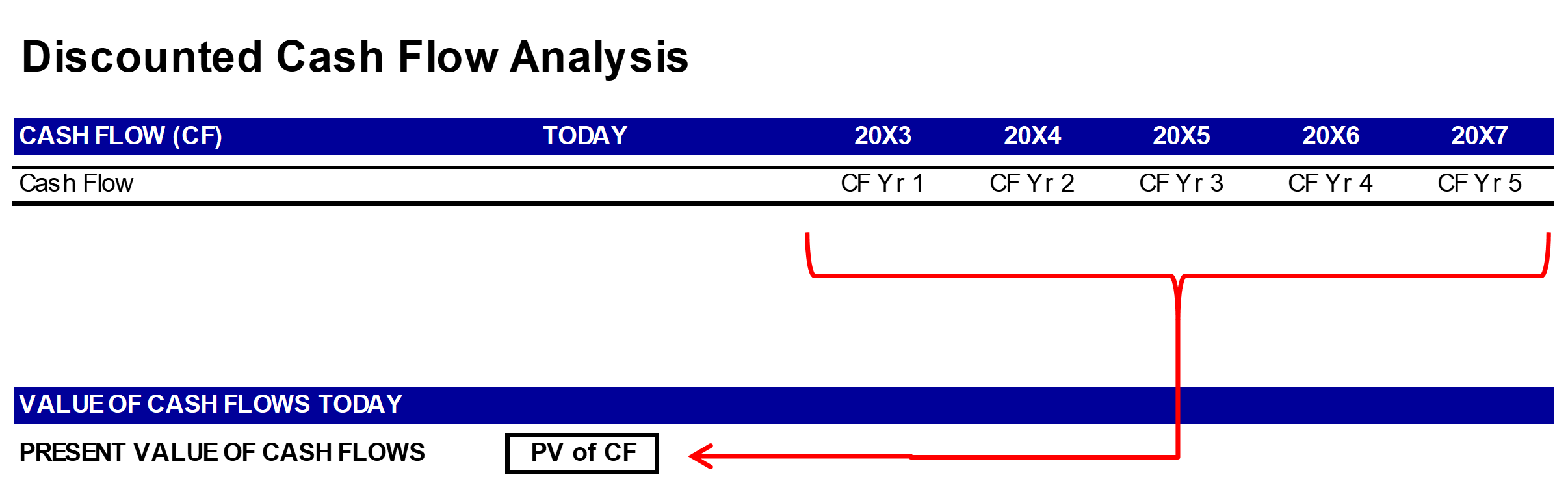

For a helpful visual, consider the image below:

Glossing over the math required for the calculation, you can see that the purpose is to determine the sum of all future cash flows and determine the present value of these cash flows.

Present Value: The value of projected cash flows today.

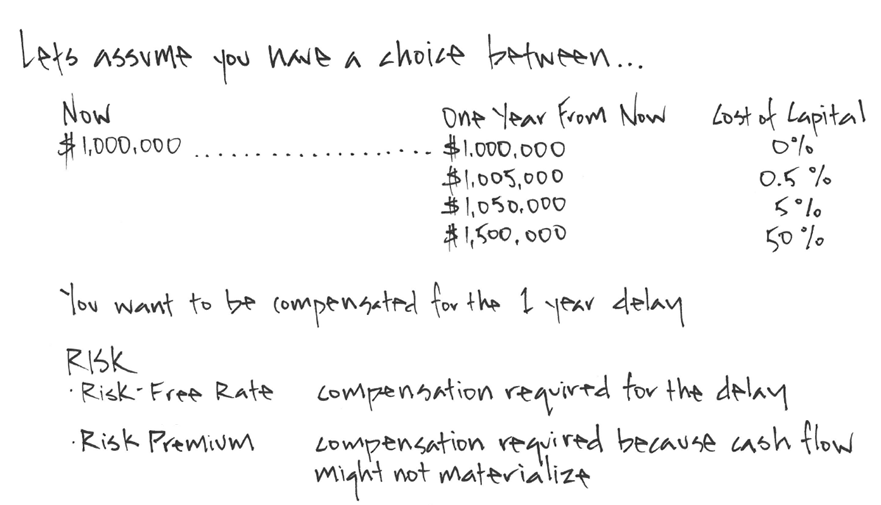

To determine present value you must first determine your cost of capital. To better illustrate the cost of capital concept, the instruction provides an example in which you are asked to think about the yield you would require to forgo receipt of $1M today, and instead wait one year:

It follows that cost of capital is determined by the yield an investor requires to be compensated for time and risk.

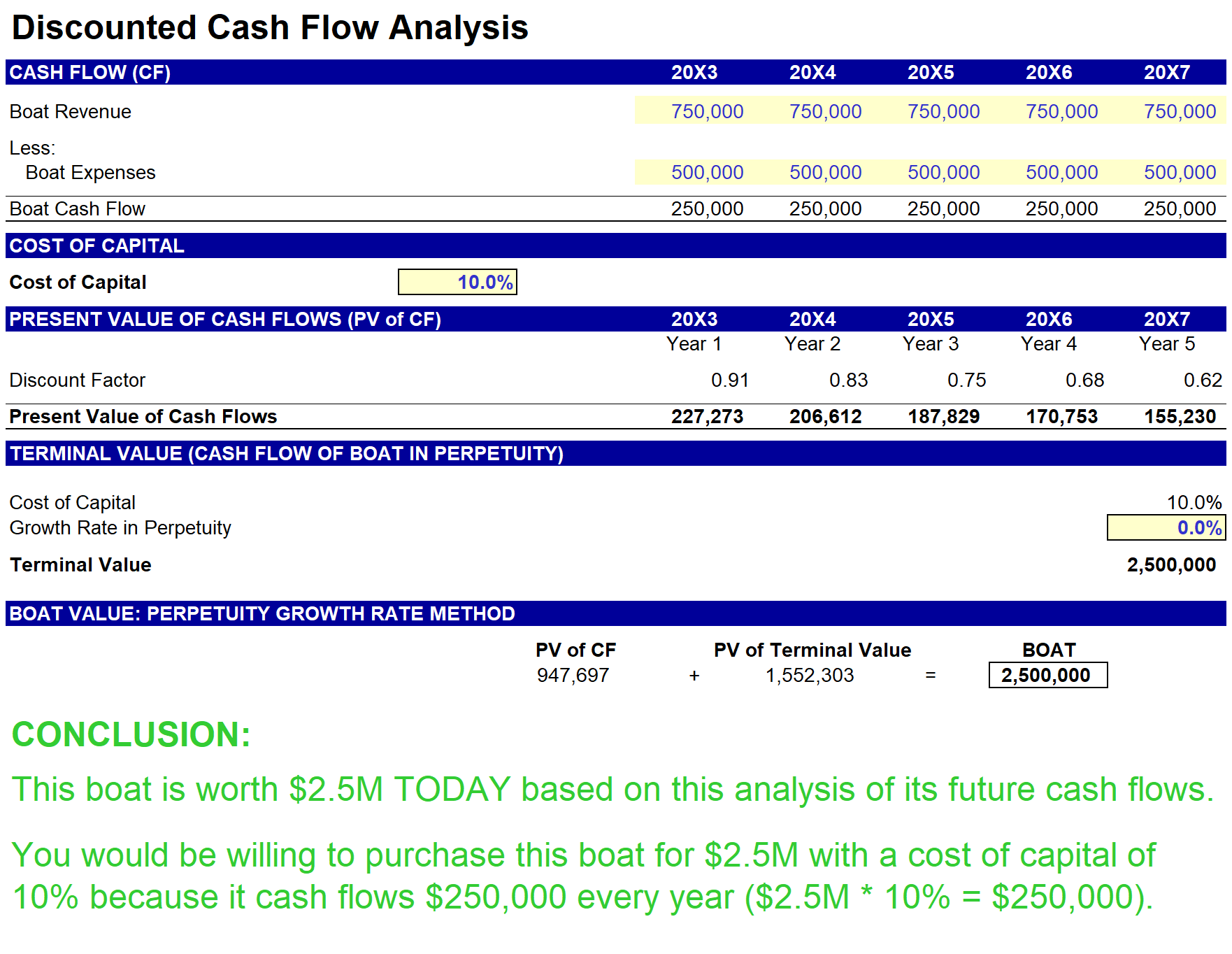

To bring all of these concepts together for the first time, the instruction focuses on a simple example to limit the amount of vocabulary required to build a basic discounted cash flow model. The first DCF walk-through exercise focuses on a DCF analysis of a boat rented out to tourists.

By the conclusion of the exercise you will know what to pay for this boat today based on the cash flows you believe it will generate in the future. You will have built the DCF template you see below:

The first video providing DCF instruction intentionally attempts to limit vocabulary so that you can focus on the mechanics of building the model.

After this introduction the video series proceeds with the following topics to dive deeper into the vocabulary and demonstrate how to pull data from a three statement model.

Net Present Value (LINK)

This video provides a concise introduction to net present value (“NPV”). NPV is an important theme in DCF analysis.

Weighted Average Cost of Capital (LINK)

The weighted average cost of capital (“WACC”) is used to determine a company’s cost of capital. This video introduces the subject and demonstrates how to calculate WACC in a financial model.

Discounted Cash Flow Model (LINK)

This video walks through a more thorough discounted cash flow (“DCF”) model. In this video we will use an integrated financial statement model to perform a DCF analysis of a company.

Mid-Year Convention

This video explains the mid-year convention in a discounted cash flow model.

For the full DCF video seriesplease click here. Once you have completed the DCF video series, ASM suggests progressing with the LBO video series.