Financial Analyst Fundamentals

Everything you need to get started as a financial analyst.

Private Equity Training

Learn how private equity professionals source, structure and close transactions.

ASM+

$10/month

Cancel Anytime

ASM+ PRO

$25/month

Cancel Anytime

If you are a university professor interested in providing access to your students please click here.

Check us out on social media!

Who We Help

Students

Simplifying financial modeling concepts, supporting students in building essential skills for success.

Learn More

Professionals

Enhances professional decision-making with intuitive financial modeling resources.

Learn More

Professors

Professors can access user-friendly tools here for teaching finance modeling with ease.

Learn More

Corporations

This platform streamlines corporate training and hiring by offering effective, data-driven models and resources.

Learn More

Private Equity Training

Created by

Industry Professionals

The “How-to-Buy-a-Business” Course

Testimonial

I'd just like to thank you for sharing your knowledge and expertise with students such as myself. I can't begin to tell you how valuable this material has been for school, work, and prepping for interviews, and best of all it costs a fraction of the market price -- so sincerely thank you.

Curtis L. Carlson School of Management,

Student

As an IB analyst looking to improve my LBO modeling, I've found your site to be more concise and understandable than any of the larger, more expensive providers I've had experience with. I will definitely recommend A Simple Model to anyone looking to learn or improve their modeling.

Fidus Partners,

Analyst

Absolutely loved the content on A Simple Model. I found it to be very lucidly explained, which helped me revise the basic modelling skills at a great pace. The drawings and quotes were the cherry on top!

Deutsche Bank,

Associate

Just wanted to say thank you! I ran through the Intro to Financial Statements, Integrating Financial Statements, and LBO modules in a week and went from never having read a balance sheet to passing my (first round) model test with KKR. Amazing site!

London,

Management Consultant

A big thank you for making financial modeling easy to learn and affordable. I recently landed a FT position with a boutique bank after completing a three hour modeling test. Your systematic approach to disassembling the puzzle through simple and lucid instruction was akin to building a burrito at Chipotle.

Innovation Capital,

IB Analyst (and Chipotle Fan)

Learn to Build Financial Models

The self-study financial modeling curriculum is focused on the three primary financial statements and the three types of financial models that collectively provide a strong foundation for an aspiring financial analyst. If you are new to financial modeling and Microsoft Excel, there is a video series available to get you up to speed as quickly as possible.

Private Equity Training

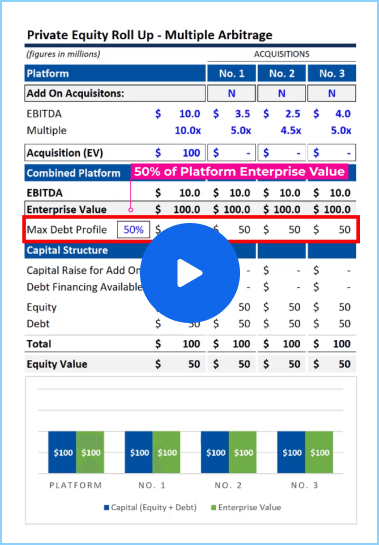

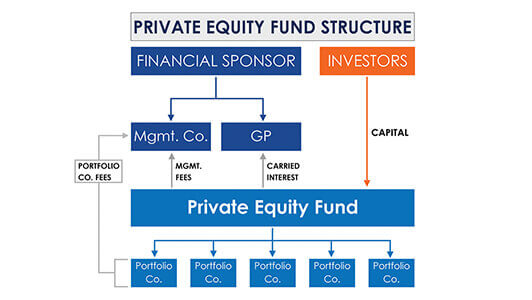

The Private Equity Training course at ASimpleModel.com was developed by industry professionals. The content goes beyond the LBO model to explain how private equity professionals source, structure and close transactions.

LBO Case Study Solution

In this course, we are going to work through an LBO Case Study. This case study was created entirely by private equity industry professionals as part of a content creation initiative with Katten, an innovative law firm with 600+ lawyers. The objective of this case study solution will be to demonstrate how a transaction might be modeled on a live deal, complete with a step-by-step walk through of the model building process.

We believe that financial literacy is paramount, which is why we work hard to keep ASM content as affordable as possible. We also want to continue to develop the best resource available and ensure that the website will remain in place forever.

If this is a concept you believe in, please sign up. More subscribers will permit the development of new material and greater technology.

Peter Lynch, Founder

Financial modeling does not take place exclusively in Excel. It is a unique skill that hones the ability to make complex financial matters simple by identifying what is actually important.

The skill set can help you visualize the variables that create or consume cash in a company, or help you decide between investment opportunities. You may never build a discounted cash flow model in your life, but understanding how money loses value over time will help you create value in the long run.